Salesforce Automation

Nanonets

JUNE 6, 2024

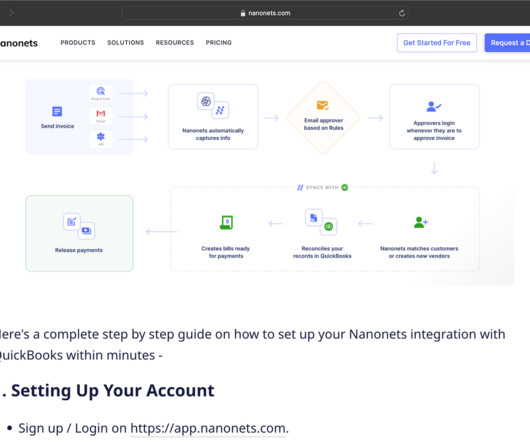

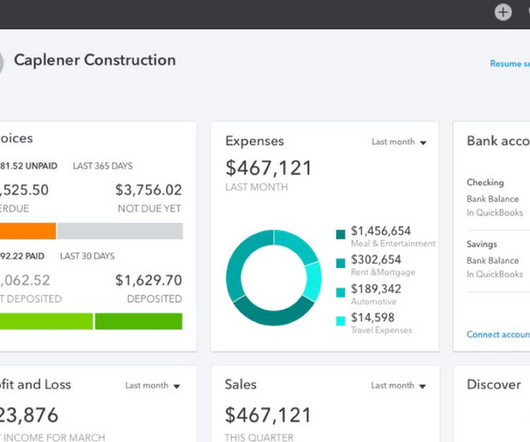

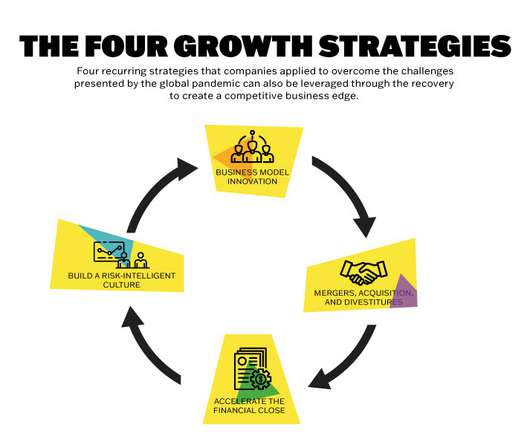

Automation within Salesforce addresses these challenges by streamlining workflows, reducing manual interventions, and enhancing overall operational efficiency. Benefits of Automation in Salesforce As with most of today’s newly automated accounting and bookkeeping processes , automation is a boon to Salesforce.

Let's personalize your content