How to automate insurance underwriting

Nanonets

SEPTEMBER 27, 2024

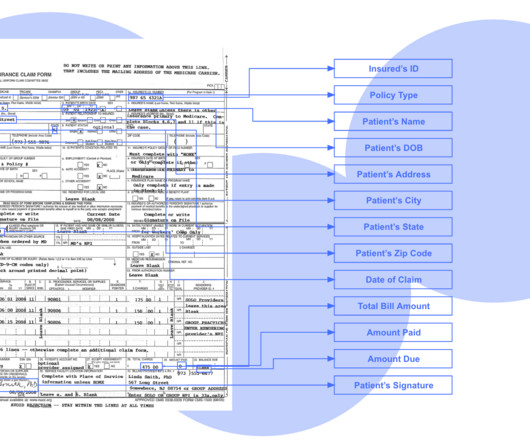

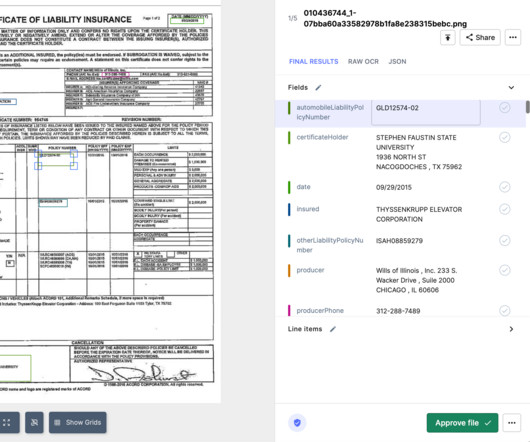

Traditional (manual) underwriting processes often struggle to keep pace with the growing complexity of modern risk assessment, data collection, and policy management. These include customer applications, financial records, medical reports, and external risk assessments such as geographic or weather-related data.

Let's personalize your content