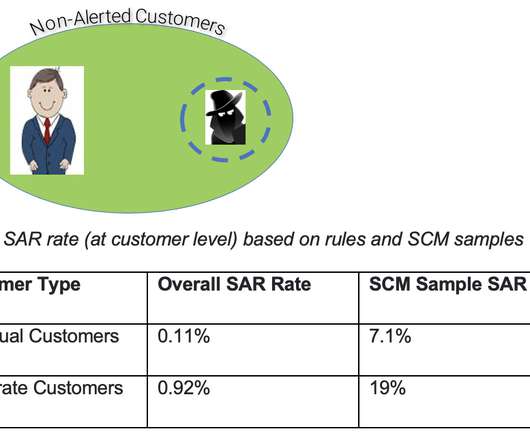

FinCEN Files Show Banks’ ‘Whack-a-Mole’ Battle Against KYC/AML

PYMNTS

SEPTEMBER 21, 2020

Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) show that several of the largest global banks moved money on behalf of scores of individuals and enterprises involved in criminal financial activity. As BuzzFeed reported, “laws that were meant to stop financial crime have instead allowed it to flourish.

Let's personalize your content