FinCEN Files Show Banks’ ‘Whack-a-Mole’ Battle Against KYC/AML

PYMNTS

SEPTEMBER 21, 2020

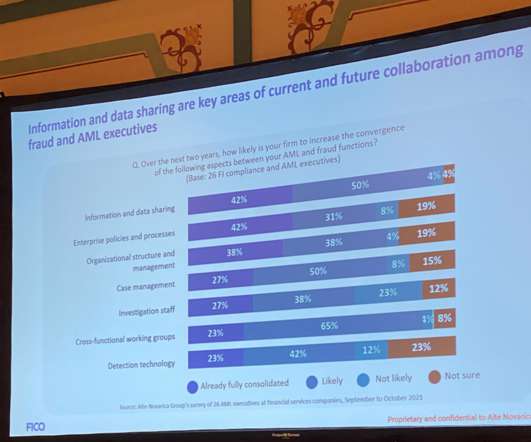

And in PYMNTS’ own coverage, the twin external forces of regulatory scrutiny and market pressures are pushing FIs to retool and strengthen their anti-money laundering (AML) efforts. The agencies offered a bit more transparency in identifying politically exposed persons to aid in AML efforts. In one example, reported on Monday (Sept.

Let's personalize your content