AMLYZE: Is the Global Anti-Money Laundering (AML) System Broken?

The Fintech Times

APRIL 29, 2024

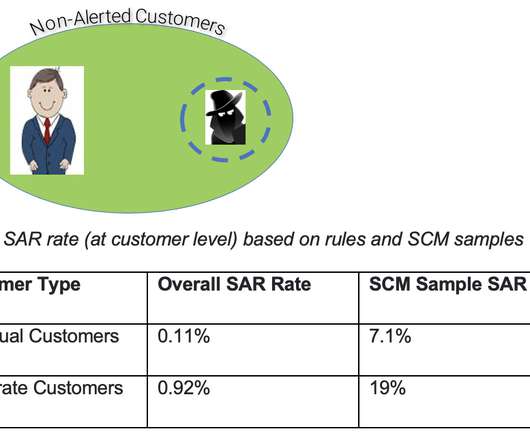

In the last two decades, anti-money laundering (AML) regulatory framework, processes and mechanisms have not changed much. Alexandre Pinot , co-founder and head of innovation and strategy at Vilnius, Lithuania, headquartered AMLYZE , the AML/CFT compliance firm explains where the gaps in the current AML system are.

Let's personalize your content