AI Meets AML: How Smart Analytics Fight Money Laundering

FICO

FEBRUARY 13, 2017

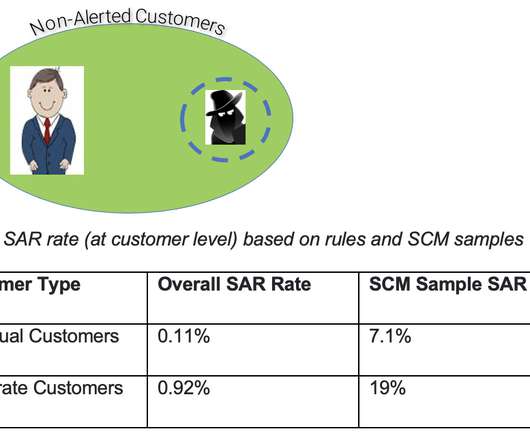

One of the places where AI can make a huge difference today is in anti-money laundering (AML). These benefits include: More effective than rules-based systems: AML systems are overwhelmingly rules-based. Different clusters have different risk, and customers that are not within any cluster are suspicious.

Let's personalize your content