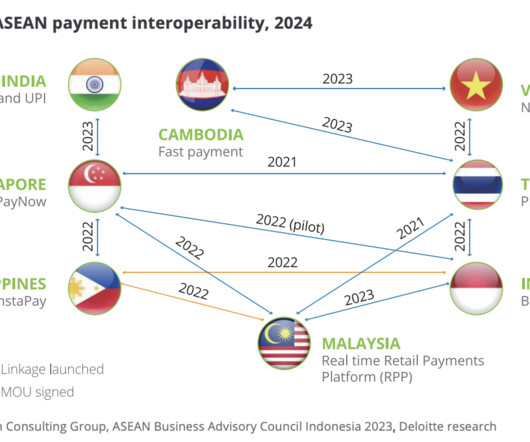

Revolutionising Cross Border Payments in the APAC Ecosystem

Fintech News

APRIL 11, 2024

In the Asia-Pacific (APAC) region, the economic growth narrative is interwoven with technological innovation, propelling the B2B payments market into new realms of possibility. These diverse payment modalities symbolise businesses’ dynamic strategies to navigate the varied financial terrains across the Asia-Pacific region.

Let's personalize your content