Choosing the right PCI DSS SAQ for your self-assessment

Basis Theory

OCTOBER 15, 2024

We cover the PCI self assessment questionnaire and other forms in this post! A business has 2 ways of demonstrating compliance with PCI DSS.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Basis Theory

OCTOBER 15, 2024

We cover the PCI self assessment questionnaire and other forms in this post! A business has 2 ways of demonstrating compliance with PCI DSS.

Fintech News

JULY 1, 2024

Singapore has released its updated Terrorism Financing National Risk Assessment (TF NRA) and National Strategy for Countering the Financing of Terrorism (CFT) to address terrorism threats. The assessment also notes the rising concern of far-right extremism, although it has not significantly impacted Southeast Asia.

The Fintech Times

NOVEMBER 14, 2024

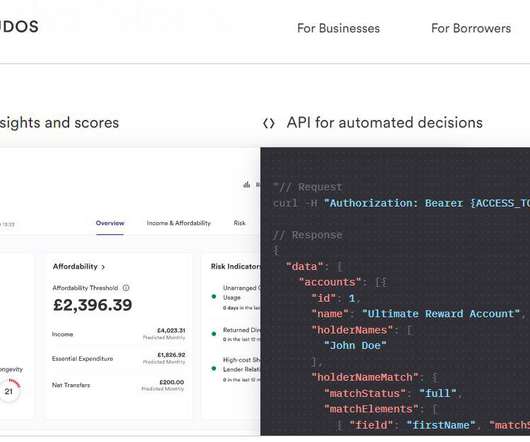

Credit reference agency Equifax UK has launched a new solution for lenders, combining bureau insights with real-time transaction data accessed via open banking and statistical estimates to boost affordability assessments and customer outcomes.

The Fintech Times

JANUARY 6, 2024

The European Central Bank (ECB) has revealed plans to carry out cyber resilience stress tests on 109 of the banks it directly supervises in 2024, to assess how they both respond to and recover from a cyberattack. Supervisors will subsequently assess the extent to which banks can cope under such a scenario.

Advertisement

Just by embedding analytics, application owners can charge 24% more for their product. How much value could you add? This framework explains how application enhancements can extend your product offerings. Brought to you by Logi Analytics.

Fintech Review

OCTOBER 16, 2024

This due diligence helps in assessing whether the high yield rates are likely to be maintained or are a temporary phenomenon. The post Yield Farming and Liquidity Mining: Assessing Risks and Rewards appeared first on Fintech Review.

Finezza

JULY 14, 2024

Typically, such borrowers apply for a line of credit, which allows them to get access to funds […] The post Assessing Line of Credit Applications: Best Practices for Lenders appeared first on Finezza Blog. The funds may be used for a home renovation, expenses after a job lay-off, or to fund business operations.

Nanonets

NOVEMBER 11, 2024

This post dives into table extraction evaluation, beginning with the essential components and metrics for gauging extraction quality. Roadmap for the Post: • Understanding Table Extraction : Core components and unique challenges. • Basic Metrics : Starting metrics for assessing extraction quality.

Seon

APRIL 24, 2024

million households in the United States lack access to traditional financial services, the challenge of assessing creditworthiness is more pressing than ever. This data helps paint a picture of what to expect from customers in different regions, aiding in the detection of potential fraud and assessing loan default risks.

FloQast

NOVEMBER 20, 2023

One of the first steps in carrying out an effective internal audit is to perform an internal audit risk assessment. What Is an Internal Audit Risk Assessment? In an internal audit risk assessment process internal auditors use to evaluate an organization’s potential risks and vulnerabilities.

Neopay

DECEMBER 20, 2023

1371) will introduce notable changes in the assessment of risks associated with Politically Exposed Persons (PEPs). In the case of customers identified as domestic PEPs or having close associations with domestic PEPs, the initial risk assessment will consider them to present a lower level of risk compared to non-domestic PEPs.

Fintech News

FEBRUARY 8, 2024

The post Are APAC Businesses Ready? Assessing Digital Preparedness in Finance appeared first on Fintech Singapore.

The Fintech Times

FEBRUARY 19, 2024

The post CRIF ESG Analytics Service Empowers UK Banks in Assessing Suppliers and Customers appeared first on The Fintech Times.

FICO

AUGUST 10, 2022

Covid to Cost-of-Living: Assessing Affordability in Uncertain Times. Affordability Assessments and Unrestrained Lending. Reasonable steps to assess and understand a customer’s ability to be able to pay in the future had to be taken, to ensure financial difficulties or adverse consequences were not incurred. by Matt Cox.

CB Insights

AUGUST 12, 2021

Moody’s , an integrated risk assessment firm, has acquired RMS , a risk management solutions provider, for $2B. Moody’s: New York-based Moody’s is a global integrated risk assessment firm that provides analytical solutions and insights for risk management. Want the full post? Who are the parties to the deal?

Fintech Finance

OCTOBER 24, 2024

Set to go live in early 2025, this premiere payments solution will integrate Plaid’s instant account verification (IAV) and network-powered risk assessment capabilities into Dwolla’s pay by bank platform. The post Dwolla Partners with Plaid to Future-Proof Pay by Bank Payments appeared first on FF News | Fintech Finance.

FICO

MAY 29, 2020

In the UK alone, it is estimated that more than 80 million affordability assessments are completed each year, most of which are done manually over the telephone. It has taken a long time, but the capabilities are now available to make affordability assessment quick, safe, forward-looking, and intelligent.

FICO

OCTOBER 11, 2018

The first step in managing risk is quantifying it — and that’s exactly what the Assessment of Business Cybersecurity (ABC) does. Today marks the release of the first quarterly Assessment of Business Cybersecurity, at the Chamber’s Seventh Annual Cybersecurity Summit in Washington, DC. businesses. The ABCs of the ABC.

CB Insights

APRIL 8, 2021

Trends highlighted in the report include: Want the full expert post? The post ESP Vendor Assessment Matrix — Digital Asset Custody appeared first on CB Insights Research. The purpose of the analysis is to guide technology buyers on the relative strength of private companies. Become a CB Insights customer.

VISTA InfoSec

OCTOBER 21, 2024

ICT Risk Management The first pillar of the DORA ICT risk management implies that financial entities must implement strong risk management frameworks to identify, assess, and mitigate risks related to Information and Communication Technology (ICT). This ensures that systems can withstand and recover from disruptions.

FICO

DECEMBER 19, 2022

Assessing Digital Identity — You Need to Ask “Who?” With this framework, FIs can effectively take false positives and assess for authorized fraud/scam exposure. See all Posts. Related posts. AND “Why?”. FICO Admin. Thu, 08/22/2019 - 12:37. by Adam Davies. Vice President, Product Management. expand_less Back To Top.

VISTA InfoSec

MARCH 6, 2024

In this post, we’ll break down the key changes to Requirement 10 from PCI DSS 3.2.1 assessment, understanding these changes to Requirement 10 will help you strategize your implementation approach. Risk Assessment Requires performing a risk assessment post-failure, to consider any further actions needed.

PYMNTS

DECEMBER 11, 2020

But because we're in a pandemic, we're also trying to assess how they're doing in 2020, and what their plans might be to get back up and running to where they were previously.". It will also include the continuing practice of looking beyond historical data to assess SMBs' future performance when decisioning and underwriting a loan.

FICO

MARCH 22, 2022

Banks need to implement advanced, real-time, SME lending systems so they can focus on collating 1st and 3rd party data for their customers, improve risk assessment, automate decisioning as much as possible and provide a lending channel that is scalable. What do SMEs need from their banking providers post-pandemic?

Fintech News

NOVEMBER 18, 2024

Navigating the Quantum Shift: A Framework for Transitioning to Post-Quantum Cryptography: Experts will guide attendees through the steps necessary to prepare for the quantum computing era and adopt quantum-resistant security measures.

Fintech News

NOVEMBER 20, 2024

The HSBC Sustainability Improvement Loan links the interest rate on the loan to the borrower’s sustainability rating, as assessed by EcoVadis. Featured image credit: Edited from Freepik The post HSBC Helps Singapore SMEs Boost Sustainability with New Loan appeared first on Fintech Singapore.

Finezza

NOVEMBER 8, 2024

Unlike regulated banks, which must adhere to the strict RBI guidelines for documentation, credit assessment, and compliance, P2P platforms often operate with minimal requirements.

Fintech News

NOVEMBER 10, 2024

These applications will be assessed on a case-by-case basis and will require proof of legitimate needs. Individuals can appeal the restriction to the Commissioner of Police, with a guarantee of a swift assessment process. The restrictions will be valid for 30 days, with possible extensions up to a maximum of 150 days.

PYMNTS

NOVEMBER 13, 2020

The beleaguered sector, which has produced bankruptcies more than success stories, was redeemed by Dillard’s as it rode impressive cost controls and inventory management to post a profit. Even though its comp sales were off 24 percent year over year, it posted $31 million in net income. Macy’s will report on Thursday (Nov.

FICO

JANUARY 6, 2021

Posts dealing with debt collection were among the most popular on the FICO Blog last year, for obvious reasons. Here were the five most popular posts in this category last year: #1. Bruce Curry brought his experience to bear in a series of posts, beginning with this one. 8 Success Tips For Debt Collection In The Pandemic.

FICO

FEBRUARY 7, 2023

Home Blog FICO Top 5 Scores Posts of 2022: Steady FICO Score, BNPL and Alternative Data 2022 marked the first year in over a decade the average FICO Score did not increase, while the industry’s attention remained on topics such as alternative data and BNPL. Read the full post 2. Read the full post 3. Read the full post 4.

Bank Automation

OCTOBER 23, 2024

Experts are assessing the effects of the Personal Data Right rule on consumers, competition and innovation following the Consumer Financial Protection Bureau’s announcement of the finalized rule.

Fintech News

DECEMBER 12, 2023

Credit rating agency S&P Global Ratings has unveiled its new stablecoin stability assessment service, designed to evaluate their capability in maintaining a stable value in comparison to traditional fiat currencies. The assessment methodology employed by S&P Global Ratings is thorough and multifaceted.

Fintech News

NOVEMBER 13, 2024

For the public sector, the programme will deliver specialised webinars on cybersecurity challenges, conduct crisis simulation exercises to assess cyber readiness, and develop research reports and risk assessment tools for ASEAN governments. Satvinder Singh, Deputy Secretary-General of ASEAN for ASEAN Economic Community.

FICO

APRIL 27, 2017

The EFL credit risk score is created through a dynamic behavioral design and psychometric assessment that analyzes character traits with a proven relationship to credit risk. For example, when assessing a new data source or scoring approach, we apply a six-point test to make sure the approach will deliver in the real world.

Fintech News

OCTOBER 28, 2024

Frederic Ho, VP, Asia Pacific, Jumio Jumio’s comprehensive data hub provides access to a wide array of industry-leading, third-party data sources to provide additional assurance of customers’ identities and assess their risk to automatically drive decisions in client workflows.

Fintech News

JUNE 23, 2024

Singapore has released its updated Money Laundering (ML) National Risk Assessment (NRA) , highlighting increased risks in the digital payment token (DPT) services sector. The updated assessment highlights increased risks due to economic and geopolitical shifts, as well as the rise in technology-enabled transactions.

CB Insights

MARCH 25, 2022

window.ClearbitForHubspot.addForm($form); }, region: “na1”, portalId: “763793”, formId: “43c769ca-a0ef-4952-9926-d926d9a4c885” }); Want the full post? The post Apple acquires Credit Kudos, an open banking startup that provides credit assessments, for $150M. Download the report to learn more.

Fintech News

NOVEMBER 6, 2024

The integration of ADVANCE.AI’s technology provides features such as real-time identity verification, fraud detection, and risk assessments, which help financial institutions meet regulatory demands securely. The post Brankas and ADVANCE.AI These tools are also intended to reduce the risk of fraud and scams. Brankas and ADVANCE.AI

VISTA InfoSec

MARCH 5, 2024

This blog post will delve into one such critical area – Requirement 9: Restrict Physical Access to Cardholder Data. Whether you’re a business owner, a security professional, or just someone interested in data security, this blog post will provide you with valuable insights into the latest updates in PCI DSS Requirement 9.

Finezza

JANUARY 4, 2024

A combination of superior risk assessment, fraud detection capabilities, and quick and accurate underwriting turnaround can transform a lender’s success rate with borrowers and reduce non-performing assets. The revenue growth and profitability of a lending business depend on several factors.

The Payments Association

OCTOBER 22, 2024

It represents a major regulatory shift, requiring firms to enhance governance, fair value assessments, and customer support, with significant compliance challenges. According to the FCA, every firm is expected to assess the risks their products and services carry to consumers and act accordingly to prevent potential harm.

PYMNTS

NOVEMBER 3, 2016

that would analyze a customer’s posts on Facebook to help set the premiums of the policy. We have made sure anyone using this app is protected by our guidelines, and that no Facebook user data is used to assess their eligibility. Facebook has reportedly ruled out launching a new car insurance policy from Admiral Insurance of the U.K.

FICO

FEBRUARY 12, 2023

Home Blog FICO Top 5 Customer Development Posts of 2022: Digital Banking and Pricing Opti The most popular posts in our Customer Development category dealt with digital banking, optimizing credit line increases, loan pricing and machine learning for credit risk models. Here are extracts from those customer development posts.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content