How Does Merchant Underwriting Work?

EBizCharge

NOVEMBER 12, 2024

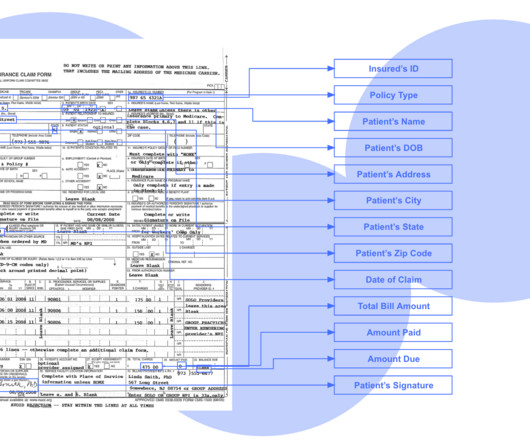

Merchant underwriting is an essential component of the payment processing industry, ensuring the safety and security of electronic payments. This article will explore the mechanics of merchant underwriting, from the essential steps involved in the process to the factors influencing it. What is merchant underwriting?

Let's personalize your content