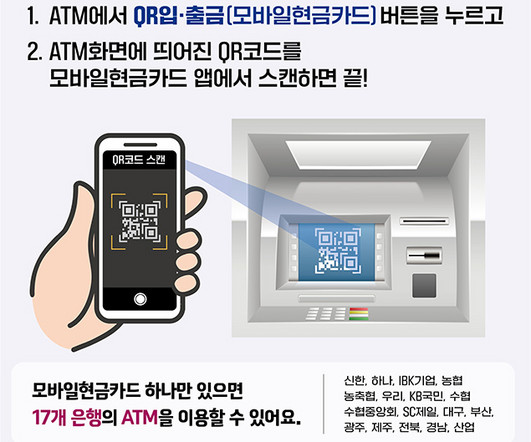

Korean banks let consumers make ATM cash withdrawals and deposits with their smartphones using QR codes

NFCW

DECEMBER 18, 2023

SCAN: Availability is being expanded from NFC on Android phones to QR Codes on all smartphones Consumers in Korea can now make cash withdrawals and deposits at ATMs by scanning a QR code with their Apple or Android smartphone rather than needing to use a physical bank card.

Let's personalize your content