Data Breaches 101: What They Are And How To Prevent Them

VISTA InfoSec

FEBRUARY 25, 2024

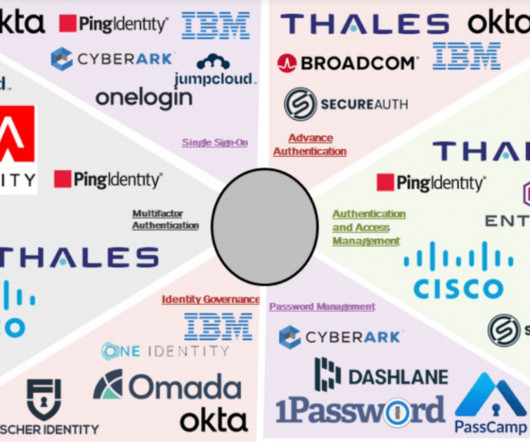

Best Practices For Prevention Ultimately, consistent vigilance and proactive security safeguards offer the best breach protections. Secure Passwords Enforce complex password requirements, password manager usage, frequent rotation policies, and supporting infrastructure across all accounts with access to sensitive data.

Let's personalize your content