How to Audit Bank Reconciliation?: A Complete Guide

Nanonets

APRIL 24, 2024

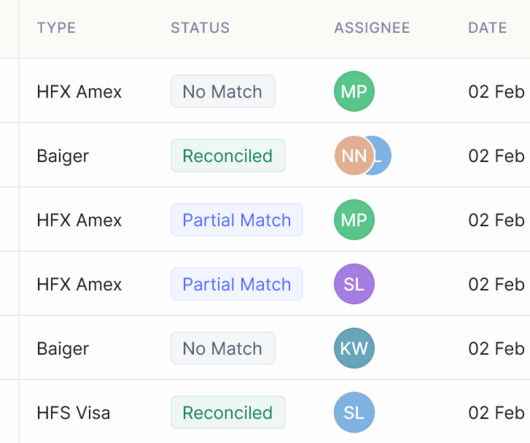

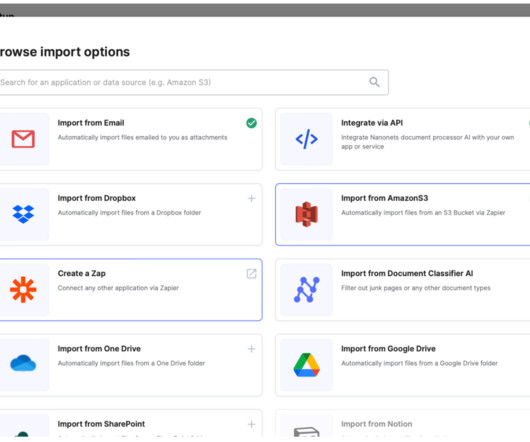

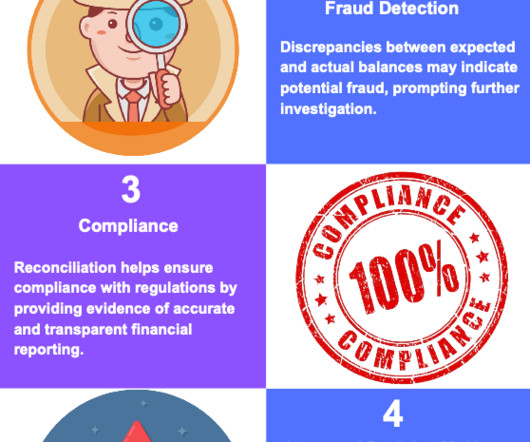

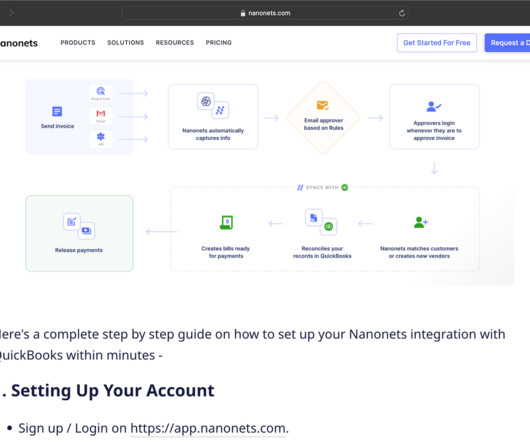

Audit Bank Reconciliation Guide Both internal and external accounting audits are essential parts of financial management as well as organizational risk management. A bank reconciliation audit is one such process that helps in identifying financial gaps or discrepancies. Looking out for a Reconciliation Software?

Let's personalize your content