What is document workflow automation?

Nanonets

AUGUST 1, 2023

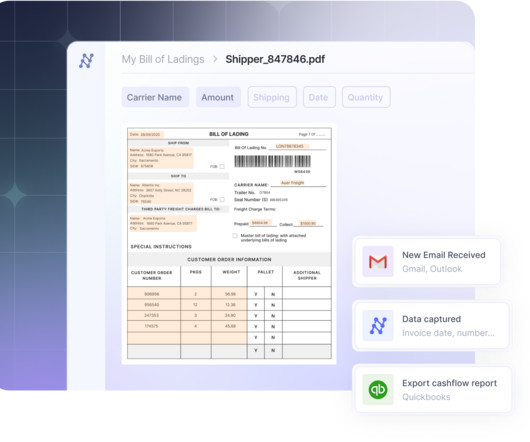

In today's information-driven world, collaboration and communication within teams heavily rely on data and documents. From contracts and invoices to manuals and reports, documents play a vital role in conveying structured information that can be easily shared, understood, and acted upon.

Let's personalize your content