Payment reconciliation: What is it, and how can your business do it efficiently?

Nanonets

JUNE 21, 2023

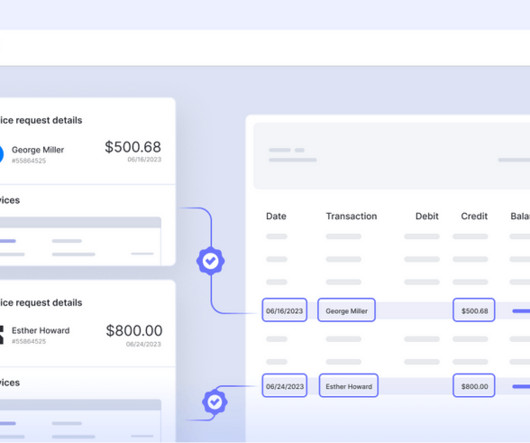

As transactions flow in and out, reconciling payments becomes crucial to ensure accuracy, identify discrepancies, and maintain a clear financial picture. Manual payment reconciliation processes can be time-consuming, error-prone, and inefficient. What is payment reconciliation?

Let's personalize your content