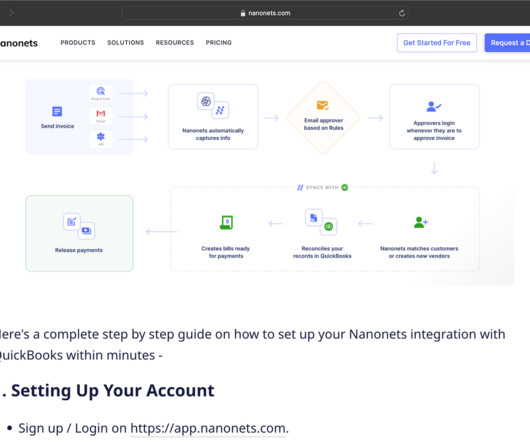

How to set up financial document automation

Nanonets

SEPTEMBER 18, 2024

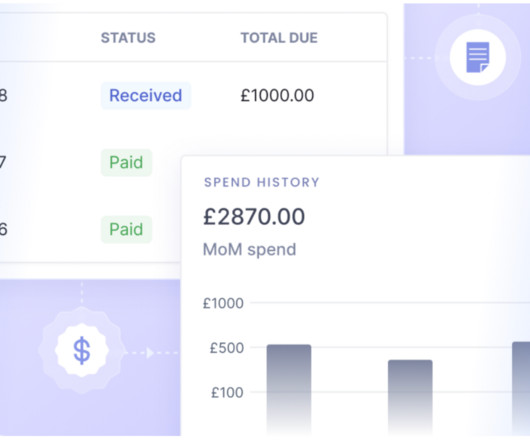

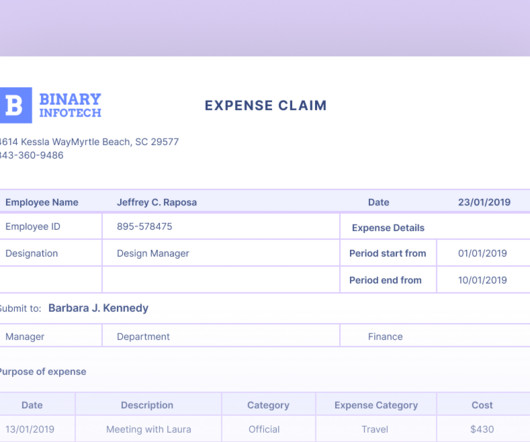

They are responsible for vendor payments, maintaining transaction records, auditing, taxation, and regulatory compliance. Automating document processing allows these firms to quickly extract financial data from various sources, perform audits with fewer manual steps, and generate reports automatically.

Let's personalize your content