71% of UK and US Banking Institutions Concerned About Regulatory Processes; AutoRek Reveals

The Fintech Times

JANUARY 25, 2024

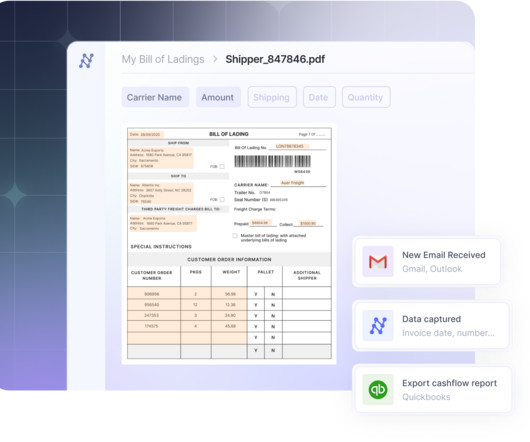

The majority of banking institutions feel they are not well enough equipped to accommodate any further regulatory change from an internal processes perspective; according to AutoRek , a fintech looking to set new standards in financial data automation.

Let's personalize your content