Decoding the FCA’s Safeguarding reforms: Practical steps for payments and E-money firms

The Payments Association

JANUARY 13, 2025

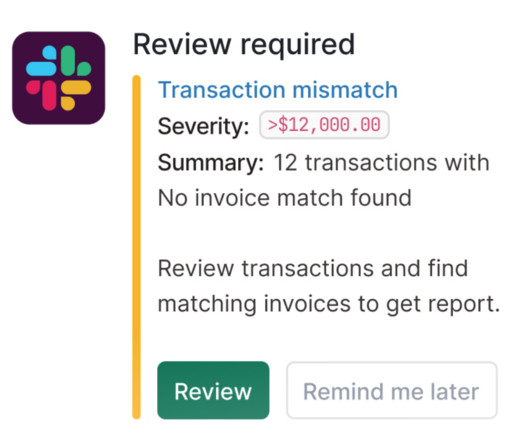

Central to these changes are new statutory trust requirements, more prescriptive record-keeping, reconciliation standards, and the mandate for external safeguarding audits. Safeguarding audits: Firms are required to arrange safeguarding audits to assess compliance with the rules.

Let's personalize your content