Report: FinCEN Files Reveal Billions In Suspicious Money Flows

PYMNTS

SEPTEMBER 21, 2020

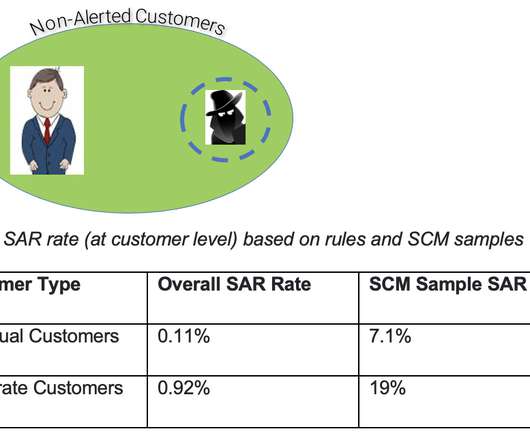

BuzzFeed said the thousands of suspicious activity reports, authored by lenders and shared with the government, offer a glimpse into global corruption enabled by banks and allowed to flourish by regulators. Of those, at least four went on to break the law again and get fined. FinCEN received more than 2 million SARs last year.

Let's personalize your content