What is finance reconciliation?

Nanonets

JULY 24, 2023

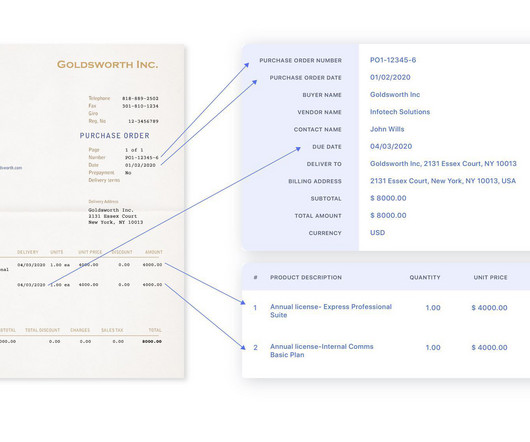

Step 5: Find errors Although rare, errors can occur on the bank's side, such as duplicate records, incorrect transaction entries, or miscalculated commissions. By automating the extraction of data from bank statements and various documents, Nanonets minimizes the need for manual data entry and reduces the risk of errors.

Let's personalize your content