myTU launches ‘Payouts API’ to Streamline Payment Processing for Businesses

Fintech Finance

MAY 22, 2024

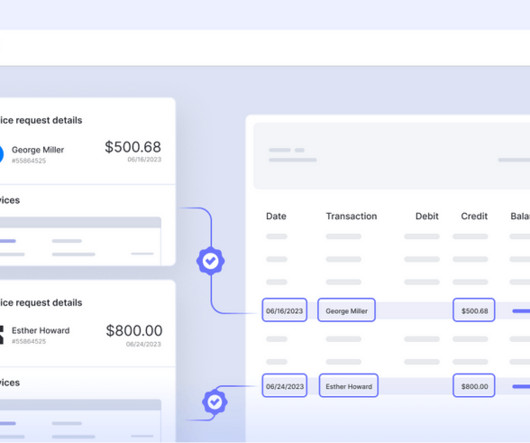

myTU , the fintech pioneering the use of cloud-only infrastructure and AI to transform consumer banking, announced the release of a new API product, “ Payouts API ,” designed to help businesses optimise their financial processes and enhance operational efficiency.

Let's personalize your content