Blockchain Technology Beyond Crypto: Fintech Innovations and Applications

Fintech Review

JUNE 25, 2024

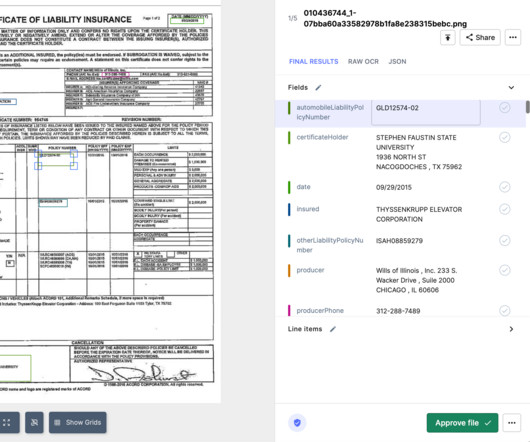

Blockchain technology, initially synonymous with cryptocurrencies like Bitcoin , has evolved beyond its origins. Smart Contracts: Automating Financial Agreements Smart contracts represent a pivotal advancement facilitated by blockchain technology. The implications for fintech are profound.

Let's personalize your content