Mama Money launches WhatsApp bank card

Finextra

NOVEMBER 19, 2024

South African fintech Mama Money Financial Services has launched a new bank card that enables cardholders to manage their account and money through WhatsApp.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Bank Card Related Topics

Bank Card Related Topics

Finextra

NOVEMBER 19, 2024

South African fintech Mama Money Financial Services has launched a new bank card that enables cardholders to manage their account and money through WhatsApp.

Fintech Finance

JUNE 24, 2024

Paymentology the leading next-gen global issuer-processor, today announces its partnership with Mama Money , one of Africa’s leading cross-border money transfer operators, and Access Bank , to launch new WhatsApp-powered bank card that stands out for its innovative use of WhatsApp banking.

Finextra

DECEMBER 3, 2024

La Banque Postale, in collaboration with WWF France, is the first traditional bank in France to launch an impact bank card where all deposits associated with the card will be used to finance the energy renovation of housing.

The Paypers

DECEMBER 4, 2024

French postal bank La Banque Postale has teamed up with WWF France to introduce an impact bank card to advance the ecological transition in the region.

Payments Dive

JANUARY 17, 2023

The big banks’ fourth quarter 2022 card volume data could have implications for card giants Visa and Mastercard, an analyst said.

NFCW

JANUARY 15, 2025

Public transportation users in Athens can now use the Greek capital city’s new tap2ride service to pay for their fares with their contactless bank card, smartphone or smart watch.

NFCW

JANUARY 23, 2025

” “CPOC payment support enables contactless payment with any NFC-enabled bank card or mobile wallet,” Zebra adds. “And support for contactless non-payment items in digital wallets enables instant validation of guest event tickets, boarding passes, loyalty cards and more.”

The Fintech Times

JUNE 25, 2024

Paymentology , the global issuer-processor has partnered with Mama Money , the African cross-border money transfer operators, and Access Bank , to launch a new bank card service that will utilise WhatsApp banking.

NFCW

JANUARY 30, 2025

Public transportation users in the greater Philadelphia and Seattle regions will soon be able to pay for their fares using their contactless bank card or NFC device. Travellers are already able to store a digital version of their myORCA travel card on an Android smartphone.device.

Payments Dive

JULY 22, 2024

Still, cardholders may have been affected, particularly in Europe, as some bank card issuers were hit by the cybersecurity company’s update snafu.

Payments Dive

MARCH 15, 2023

As bank card issuers faltered this past weekend, the card networks monitored payments closely, Visa and Mastercard executives said at a conference.

Payments Dive

APRIL 17, 2024

Despite an industry-backed lawsuit seeking to stop the Consumer Financial Protection Bureau’s new $8 late fee rule, bank card issuers are bracing for potential implementation.

NFCW

JANUARY 22, 2025

Mastercard is testing a new service that enables cardholders to simply tap their contactless bank card to their NFC smartphone in order to complete an ecommerce or other card-not-present transaction, executive vice president Jennifer Marriner has revealed.

The Nilson Report

NOVEMBER 22, 2024

The post Payhawk Integration with Mastercard to Streamline Spend Management with Bank Cards appeared first on Nilson Report.

The Nilson Report

DECEMBER 6, 2023

The post EQ Bank Card Launches in Québec as Carte Banque EQ appeared first on Nilson Report.

The Payments Association

MARCH 27, 2024

Thames Technology has announced a strategic partnership with Ellipse to offer dynamic security code technology Read more

The Nilson Report

JULY 9, 2024

The post Mama Money Partners with Access Bank and Paymentology to Launch WhatsApp-powered Bank Card appeared first on Nilson Report.

Payments Source

OCTOBER 5, 2016

Preventing fraud across multiple purchasing channels is the next major paradigm shift for bank card issuers and merchants.

The Paypers

JULY 8, 2022

Russia-based Sberbank has started removing chips from un-activated cards to combat shortage after European suppliers halted deliveries based on EU sanctions imposed on the country amid the ongoing Ukraine invasion.

Fintech Finance

JULY 17, 2024

He noted that with introduction of O-CITY, commuters can now benefit from a unified ticketing experience, eliminating the need to visit a ticket office, by conveniently paying contactlessly using a bank card directly on the bus.

Payments Source

MAY 29, 2019

Top executives from banks, card brands, credit unions, fintechs and more weighed in on the major issues and innovations for the payments industry.

Fintech Finance

NOVEMBER 27, 2024

Patients, meanwhile, can register their preferred payment methods in the Doctolib application, and pay for their consultations or those of their loved ones without worrying about whether they’ll have cash or a bank card with them when they pay for their in-office consultation.

Payments Source

FEBRUARY 11, 2021

Tech firms, banks, card networks and governments are all making strong progress toward the everyday use of digital currencies.

PYMNTS

NOVEMBER 7, 2016

Thousands of customer cards have been blocked after Tesco Bank’s fraud system detected suspicious activity, reported HuffPost Business. Concerned account holders took to social media to alert Tesco. Others reported losing funds and being on hold for hours. Tesco issued a statement on Sunday (Nov.

Payments Source

FEBRUARY 11, 2020

won approval to set up a bank card clearing business in China, gaining access to a $27 trillion payments market as part of the nation’s financial opening, though more regulatory steps will be required. Mastercard Inc.

Fintech News

DECEMBER 2, 2024

From cash-reliant to a cashless Vietnam The report, based on a consumer survey of over 2,100 participants, reveals that 37% of respondents used bank apps for their most recent purchases, making it the most popular payment method. E-wallets followed at 31%, ahead of bank cards at 18%.

Payments Dive

APRIL 1, 2024

For many companies, CaaS not only improves the customer experience but also yields expected—and sometimes unexpected—benefits for the business.

Payments Source

JANUARY 24, 2019

Midsize banks have much smaller security budgets, less mature security programs and less robust controls than their bigger counterparts, writes Leigh-Anne Galloway, cybersecurity resilience lead at Positive Technologies.

Finextra

JANUARY 25, 2024

Torpago, a commercial credit card and spend management provider, Marqeta, strategic partner of Torpago and the global modern card issuing platform, and Sunwest Bank, a leading entrepreneurial business bank, announce the launch of Sunwest Visionary Card, Sunwest’s commercial credit card and expense management solution.

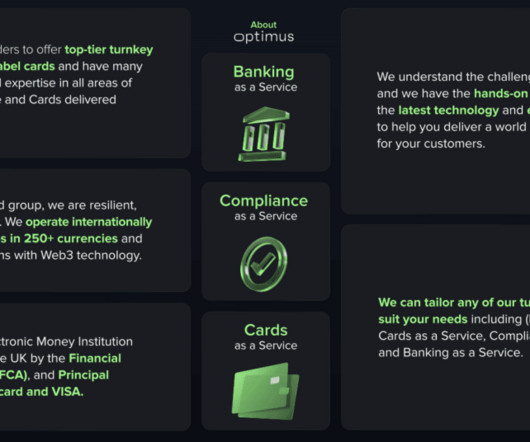

The Payments Association

FEBRUARY 27, 2025

E-money license and technological prowess Optimus’s e-money license and advanced core banking/card processing technology platforms provide a solid foundation for its continued success.

Fintech Finance

JANUARY 6, 2025

Sherif Mounir, Head of Cards at ADIB-Egypts Retail Banking Division, added: Through our partnership with PayMint, we aim to elevate the presence of FinTech in Egypt and expand the banks card portfolio, providing a more seamless and flexible banking experience for customers.

NFCW

JANUARY 16, 2024

This national project will see the introduction of ‘tap and go’ solution for customers using their bank card on regional bus services where, irrespective of which bus operators they use, they will get best value fare,” says TfWM’s Matt Lewis.

NFCW

MARCH 25, 2025

Payment by contactless bank card is already the most popular way to pay for travel on Metrolink with record numbers of people using it every year. “Automatic capping of fares opens up opportunities to make more flexible and affordable journeys under a simpler fares structure.

Payments Source

JUNE 22, 2017

The partnership is designed to serve the increasing numbers of tourists visiting Sri Lanka from India, providing payment card options that have local ATM support.

PYMNTS

FEBRUARY 11, 2020

China’s central bank gave Mastercard the go-ahead on Tuesday (Feb. 11) to set up a bank card clearing business, granting access to a $27 trillion payments market, according to reports. . The central bank said Mastercard and its partner, NetsUnion Clearing Corp. billion bank cards in circulation were debit cards.

The Paypers

NOVEMBER 21, 2023

Mastercard NUCC Information Technology (Beijing) has received formal approval to perform domestic bank card clearing activities in China.

The Paypers

JUNE 30, 2023

Portugal-based transit system Lisbon Metro has partnered with UK-based transit payments processing company Littlepay to facilitate contactless bank card payments.

Payments Source

OCTOBER 5, 2016

Preventing fraud across multiple purchasing channels is the next major paradigm shift for bank card issuers and merchants.

Payments Dive

FEBRUARY 26, 2016

The companies signed a memorandum of understanding to strengthen and create new value for the bank card ecosystem, benefiting consumers, merchants, financial institutions, and technology partners.

Finextra

MARCH 28, 2025

Tietoevry Banking has entered into a strategic five-year agreement with Fana Sparebank to deliver a comprehensive suite of banking solutions. The partnership includes core banking systems, card and payment services, and advanced financial crime prevention tools.

Fintech News

JUNE 2, 2024

Grab users will continue to have access to cashless payment options through bank cards, ZaloPay accounts, and MoMo accounts. During the transition period from 31 May to 30 June 2024, Moca users can withdraw funds to linked accounts or bank cards and use any remaining balance.

Fintech Finance

MARCH 4, 2025

This eliminates the need for carrying bank cards, reduces high international transaction fees, and offers better exchange rates, enhancing the overall travel experience. Travelers simply initiate a withdrawal via MallowLink-connected applications, generate a secure QR code, and scan it at an RCBC ATM for instant access to cash.

Payments Dive

FEBRUARY 16, 2023

Bank card issuers say there isn’t enough network competition to meet the July debit card routing rule deadline, adopting regulators’ argument to push back.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content