Visa, Mastercard say CrowdStrike didn’t impact networks

Payments Dive

JULY 22, 2024

Still, cardholders may have been affected, particularly in Europe, as some bank card issuers were hit by the cybersecurity company’s update snafu.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

JULY 22, 2024

Still, cardholders may have been affected, particularly in Europe, as some bank card issuers were hit by the cybersecurity company’s update snafu.

Payments Dive

APRIL 17, 2024

Despite an industry-backed lawsuit seeking to stop the Consumer Financial Protection Bureau’s new $8 late fee rule, bank card issuers are bracing for potential implementation.

Payments Dive

MARCH 15, 2023

As bank card issuers faltered this past weekend, the card networks monitored payments closely, Visa and Mastercard executives said at a conference.

Payments Dive

FEBRUARY 16, 2023

Bank card issuers say there isn’t enough network competition to meet the July debit card routing rule deadline, adopting regulators’ argument to push back.

Payments Source

OCTOBER 5, 2016

Preventing fraud across multiple purchasing channels is the next major paradigm shift for bank card issuers and merchants.

Payments Source

OCTOBER 5, 2016

Preventing fraud across multiple purchasing channels is the next major paradigm shift for bank card issuers and merchants.

Payment Savvy

JANUARY 11, 2023

If you are one of the ten million-plus American businesses with a merchant processing credit card account, the chances are you are aware of an industry term known as interchange. Each new credit card transaction is assigned to what is known as a target interchange category. What Is Downgrading a Credit Card. What Is a Bucket?

Payment Savvy

AUGUST 3, 2023

When you run any BIN number through a checking system, you end up with accurate information about the geolocation, card issuer, and card type. Since online banking systems have become more popular and virtual cards have become a norm, BIN numbers aren’t necessarily bank-issued. How to Use a BIN Checker?

Finovate

MAY 2, 2024

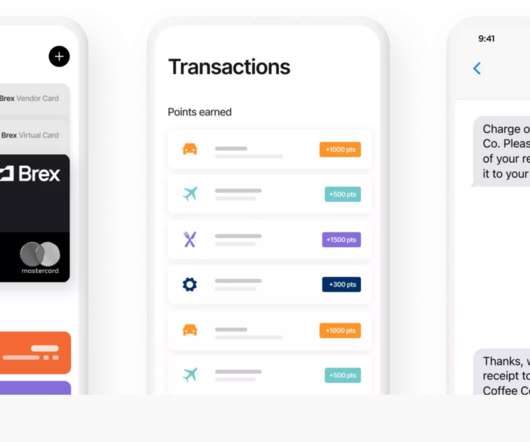

Cardlay Payment Solutions Cardlay Payment Solutio ns’ white-label card and expense management product, Cardlay Expense, delivers an exceptional, real-time experience for card users. Features A fully bank-integrated, real-time product that helps banks provide corporate card clients a highly competitive user experience.

Payments Source

JULY 10, 2016

What's most intriguing to payments industry insiders is what Walmart left on the table when designing Walmart Pay, and what those decisions could mean for retailers and bank card issuers.

EBizCharge

AUGUST 12, 2024

When navigating the realm of credit card processing, it’s crucial to distinguish between merchant acquirers (acquiring banks), card issuers, and payment processors, as each plays a distinct role in the card transaction ecosystem. Card issuers are banks or financial institutions that issue credit cards to consumers.

PYMNTS

NOVEMBER 20, 2019

Denmark B2B FinTech Cardlay announced nearly $10 million in new funding from SEB and Seed Capital, according to reports in EU-Startups , a show of support for commercial card innovation. Cardlay works with banks and card issuers to augment its existing commercial card offerings with value-added functionality.

Fintech Labs Insights

JULY 24, 2015

Bottom line : For me this would be one of the best things a bank, card issuer or PFM could do to cement my loyalty (and even cough up a modest subscription fee). The post Friday Feature Request: Banking/Card Transaction Annotation via Email appeared first on Finovate. what did I pay last month for cable?).

FICO

NOVEMBER 26, 2019

If your plastic card is captured inside of an ATM, call your card issuer immediately to report it. Sometimes you may think that your card was captured by the ATM when in reality it was later retrieved by a criminal who staged its capture. Either way, you will need to arrange for a replacement card as soon as possible.

FICO

JUNE 22, 2016

FICO has worked with a number of credit card issuers to help them segment and deliver the right analytic offer. To learn more about FICO research into Millennials and Credit Cards download our ebook or to learn more about our Bank Card Solutions visit fico.com. Segmentation.

PYMNTS

JANUARY 9, 2020

Tencent was reportedly talking to five different international card issuers about allowing cardholders outside the country to use WeChat Pay while they travel. Rival Alipay has a similar functionality that allows tourists to link their own bank cards to its app.

PYMNTS

JANUARY 20, 2021

Payments have typically been the exclusive domain of banks, card issuers and FinTechs — distinct from a product or service offering and usually requiring distinct motions for both the buyer and seller to complete a transaction. But that is changing — slowly but surely.

PYMNTS

JANUARY 29, 2020

Identifying Key Areas For Virtual Card Expansion. Bank is the country’s third-largest commercial bank card issuer, and has offered its clients virtual accounts for more than 10 years. Bank, which must educate clients and suppliers on the advantages offered by such technology. . Minneapolis-based U.S.

PYMNTS

APRIL 18, 2019

In a press release , Passport, which has more than $1 billion in payments processed to date and is a leader in payment in the transportation industry, said Hammermaster brings close to 30 years of experience working with large banks, card issuers and merchants to the table.

Clearly Payments

NOVEMBER 13, 2024

The role of the BIN extends beyond simply identifying the card issuer; it affects various aspects of the payment process: Transaction Routing : When a customer makes a purchase using a card, the payment processor uses the BIN to route the transaction to the right financial institution. Why is the BIN Important in Payments?

Stax

AUGUST 29, 2024

Learn More Understanding Payment Service Providers (PSPs) A payment service provider helps businesses with the acceptance and processing of payments made via electronic payment methods, including credit cards, debit cards, digital wallets, ACH transfers, and payment apps.

PYMNTS

FEBRUARY 3, 2017

Experts say the main reason for theft with chip cards is when banks and vendors don’t correctly implement the chip card standard, known as EMV. The only way for this attack to be successful is if a [bank card] issuer neglects to check the CVV when authorizing a transaction,” wrote NCR Corp.

PYMNTS

DECEMBER 3, 2019

Small Business Credit Card Satisfaction Study, businesses are twice as likely as consumers to switch credit card brands, with many small businesses serving “relatively low” scores for issuers’ rewards, benefits and services. But they may have a blind spot when it comes to the product itself,” said J.D.

Fintech Labs Insights

OCTOBER 14, 2021

Emigrant Bank — Card issuer. Travel Bank — Travel rewards and bookings. FAB Score = 469 (#1 on our list of the top 15 charge/credit cards targeted to U.S. Integrations with QuickBooks, Xero and others. Billpay (including paying invoices via forwarding an email)*. Spend management software*. Partnerships.

PYMNTS

MARCH 29, 2016

18, Chinese shoppers reportedly activated 3 million payment cards within the mobile wallet. According to China Merchants Bank, its customers connected 1 million bank cards to Apple Pay within the first couple days of the payment method becoming available, representing 35 percent of cards connected with Apple Pay in China.

FICO

JULY 7, 2020

Beware of people claiming to be part of reputable organizations, like research firms or government agencies, asking you for personal information like bank card numbers or your Social Security number. Pretexting entails someone contacting you and lying about who they are to trick you into giving them something they want. Fake Profiles.

PYMNTS

SEPTEMBER 14, 2020

Card issuers that are convinced of their customers’ truthfulness ask merchant acquirers to extract money from sellers’ accounts, which can then be used to refund consumers for disputed purchases. FIs must thoroughly investigate chargeback cases to protect customers when fraud does occur, but the process can be cumbersome.

Stax

NOVEMBER 21, 2024

It also ensures that data security best practices, particularly PCI DSS (Payment Card Industry Data Security Standards) requirements , are followed to the letter to prevent any breach or loss of sensitive customer data.

PYMNTS

AUGUST 20, 2018

“The FBI has obtained unspecified reporting, indicating cybercriminals are planning to conduct a global Automated Teller Machine (ATM) cash-out scheme in the coming days, likely associated with an unknown card issuer breach and commonly referred to as an ‘unlimited operation,’” the letter read, according to the report.

PYMNTS

OCTOBER 24, 2019

The conversation took a philosophical turn toward the end when Bharghavan remarked that Apple Card has changed the conversation about the role of a “credit card” and credit card issuer in the decade to come. Is a card an enabler for commerce or for Apple?

PYMNTS

AUGUST 20, 2018

“The FBI has obtained unspecified reporting, indicating cybercriminals are planning to conduct a global Automated Teller Machine (ATM) cash-out scheme in the coming days, likely associated with an unknown card issuer breach and commonly referred to as an ‘unlimited operation,’” the letter read, according to the report.

Fintech Labs Insights

AUGUST 17, 2015

If a bank, card issuer, or fintech startup cracks that barrier, they would surely be en route to fame and fortune (or at least a demo slot at Finovate ). A few track it because they are control freaks aficionados and they love the sense of order they get from processing each transaction.

Fintech Labs Insights

SEPTEMBER 15, 2014

And even if I''m wrong and you are locked out of the iPhone indefinitely, you can create an Apple Pay poaching program where your customers make their charges on a bigco bank card, then you automatically pay those charges off and essentially transfer them to your customer''s checking account. So my final advice.

Finovate

MARCH 12, 2024

The company offers a SaaS solution that manages all of the significant aspects of program management for card issuers and BIN sponsors in a single interface. ” Headquartered in Charlottetown, Prince Edward Island, PayTic made its Finovate debut last year at FinovateSpring.

CB Insights

DECEMBER 4, 2019

Swipe fees alone are a $90B-a-year business for banks, card networks like Visa, and payment processors like Stripe. The company announced it would pass on the special card savings Amazon gets from card networks (because of the volume of purchases they can guarantee) to retailers that adopt Amazon Pay.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content