Mastering Petty Cash Reconciliation: Best Practices and Automation

Nanonets

APRIL 19, 2024

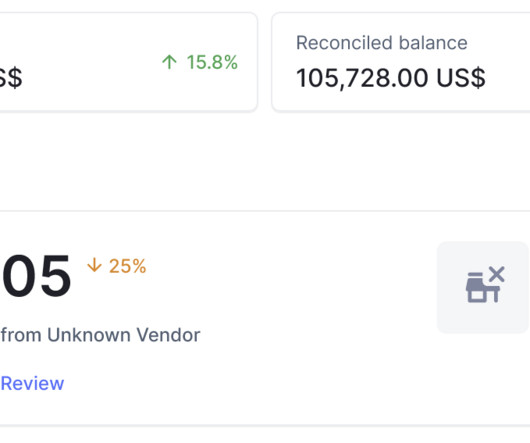

Petty Cash Reconciliation: What is It, Best Practices, and Automation Petty cash, also referred to as a small cash fund, is a fixed amount of money reserved for minor expenses in a business. Looking out for a Reconciliation Software? What are the Steps Involved in Petty Cash Reconciliation?

Let's personalize your content