Re-Examining The Role Of Correspondent Banking

PYMNTS

SEPTEMBER 1, 2020

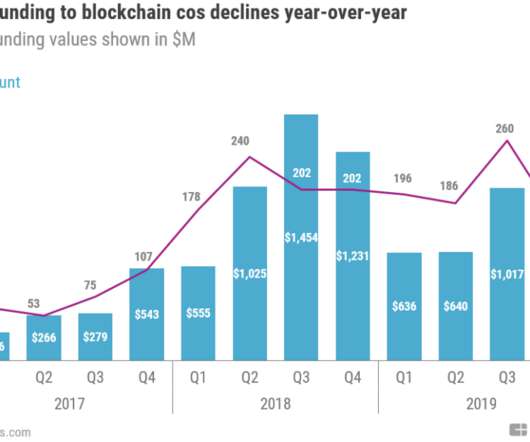

Fewer correspondent banks to move that money. For instance, the number of active correspondent banks fell about 23 percent in advanced economies, but as much as 41 percent in developing nations. And earlier this year, Harbour & Hills CEO Rahul Tripathi took note of the vagaries of correspondent banking. “I

Let's personalize your content