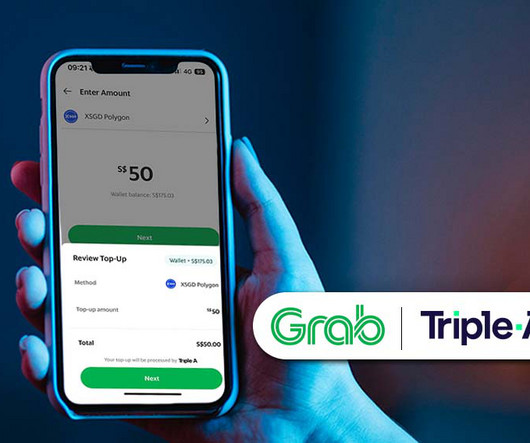

StraitsX Enables Stablecoin-Based Payments for Tourists at GrabPay Merchants

Fintech News

NOVEMBER 5, 2024

StraitsX, a digital asset payments infrastructure provider in Southeast Asia, has partnered with Ant International and superapp Grab to launch a new blockchain-based cross-border payment system. The new system uses Purpose Bound Money (PBM), which specifies the conditions for using stablecoins, and the Avalanche blockchain.

Let's personalize your content