What is Business Email Compromise (BEC)?

Nanonets

NOVEMBER 14, 2023

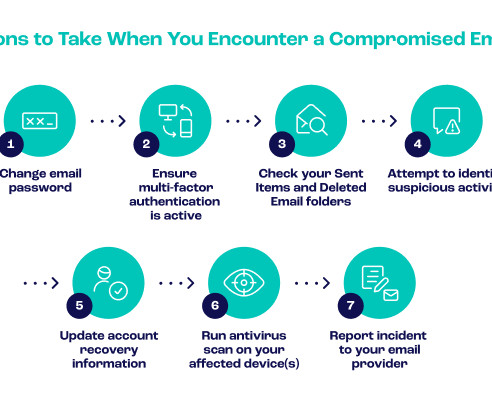

Business Email Compromise (BEC) is a cyber threat that exploits the vulnerabilities of email communication. Perpetrators impersonate trusted entities, such as executives or vendors, employing social engineering techniques to coerce employees into compromising actions. What is Business Email Compromise (BEC)?

Let's personalize your content