Securing Mobile Apps Against Malware and Phishing Attacks in Indonesia

Fintech News

APRIL 22, 2024

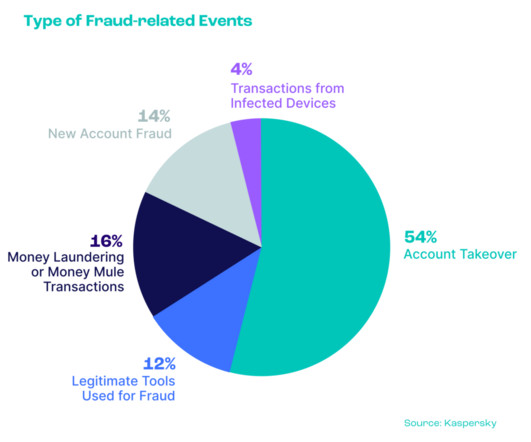

While this digital transformation offers undeniable convenience, it also introduces new challenges to mobile security in Indonesia Malware and phishing attacks pose a significant threat to the integrity and security of financial platforms, jeopardising both user data and financial security. A 2023 report by Kaspersky found that 40.8%

Let's personalize your content