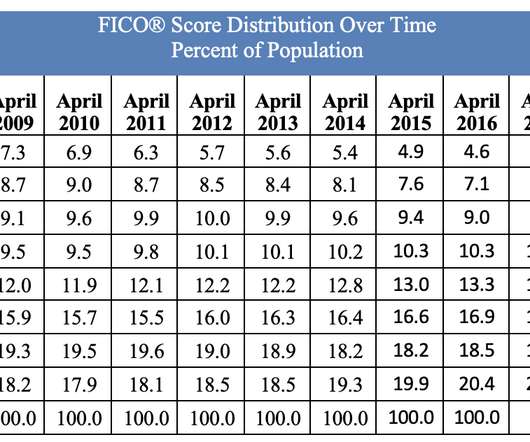

FICO Score Trends Through Economic Downturns and Natural Disasters

FICO

AUGUST 28, 2020

The FICO® Score has been a stable and highly effective tool for rank ordering credit risk through prior fluctuations in economic conditions, and we expect the FICO® Score to continue to provide strong risk rank ordering through the current COVID-19 pandemic. Make sure to check back here at fico.com/blogs to stay up to date!

Let's personalize your content