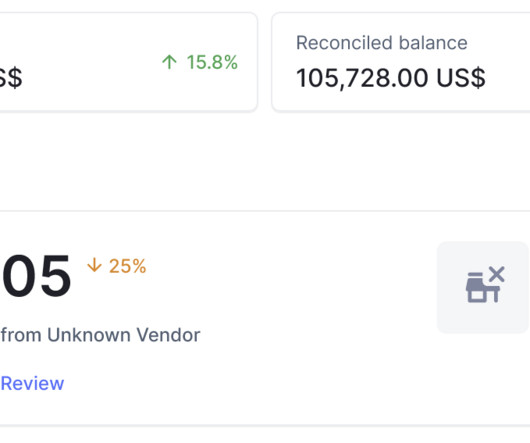

Simplifying Financial Processes with Automated Bank Reconciliations

FloQast

OCTOBER 21, 2024

With lines upon lines of figures and the potential for human error looming overhead, manual bank reconciliation can quickly become a massive headache. There sure is: Automated bank reconciliation. Automating your reconciliations both limits the possibility of errors and significantly cuts the time and effort needed.

Let's personalize your content