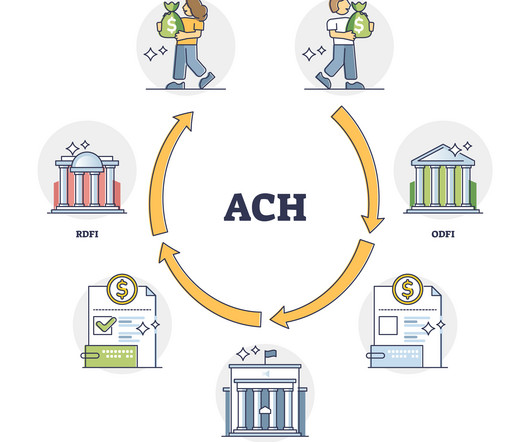

What is an ACH Deposit and How Does It Work?

Stax

APRIL 23, 2024

ACH transactions provide a quick and easy way to pay employees, submit and retrieve tax returns, and automatically control your finances within 1-2 business days. Many small businesses choose ACH operators because they are more convenient than most direct deposits. And the best part about ACH?

Let's personalize your content