Fed to review debit card fee cap next week

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

Fintech News

MARCH 17, 2025

The report said the firm also raised the spending cap on its Chocolate Visa debit card to S$1,000, up from the S$250 limit imposed on 11 March 2025, to manage what it referred to as its liquidity programme. The company is working to process withdrawals in line with its standard redemption timeline of three to six business days.

Fintech News

JANUARY 21, 2025

These changes, which include lifting restrictions on WhatsApp Pay and postponing the implementation of a market share cap for UPI apps, underscore the NPCIs commitment to create a fairer digital payment landscape in India, and ensuring equal opportunities for all participants, India TV News reported.

Neopay

DECEMBER 17, 2024

To combat this, the regulator is proposing a price cap to bring relief to businesses and their customers. Rising Fees and Limited Competition Cards are integral to the UK economy, facilitating everyday transactions between businesses and consumers. to 1.15% and credit card fees from 0.3%

Finextra

DECEMBER 13, 2023

The Payment Systems Regulator is propsing to cap cross-border interchange fees on credit and debit cards to protect UK businesses from rising costs.

Payments Dive

JANUARY 23, 2024

The Federal Reserve extended the time period during which it will accept public comments on its proposal to reduce the cap on debit card fees.

Payments Dive

JUNE 20, 2024

Senators this week introduced their version of a House bill aimed at derailing the Federal Reserve’s plan to lower the cap on fees that card issuers can charge merchants on debit card transactions.

Payments Source

MAY 14, 2020

called on European Union regulators to crack down on credit and debit card fees that have increased after laws capped so-called interchange fees five years ago. Retailers including Tesco Plc, Ikea and Amazon.com Inc.

Payments Dive

MARCH 8, 2024

President Biden and Republican lawmakers sparred Thursday over credit card late fees, as some House members also challenged the Federal Reserve’s proposed cap on debit card fees.

Stax

DECEMBER 20, 2023

In the complicated world of payment processing, understanding the nuances of debit card and credit card payments, along with associated processing fees, is essential for businesses. TL;DR Card brands such as Visa and MasterCard along with state and federal laws prohibit debit card surcharging.

The Payments Association

JUNE 28, 2024

New regulations will cap overdraft fees, drastically reducing them from around $30 to approximately $3, significantly impacting banks' revenue streams. Read more

The Payments Association

APRIL 21, 2024

New regulations will cap overdraft fees, drastically reducing them from around $30 to approximately $3, significantly impacting banks' revenue streams. Read more

The Fintech Times

AUGUST 12, 2024

US consumers are increasingly turning to debit cards for their everyday transactions, driving a significant surge in the number of transactions and overall spending. The 2024 PULSE Debit Issuer Study reveals that in 2023, the total number of debit cards, transactions and annual spending per active card all saw substantial increases.

Clearly Payments

APRIL 25, 2024

Named after its chief advocate, Senator Richard Durbin , this legislative moved was designed to fix the increasing interchange fees charged by banks for debit card transactions. Prior to the Durbin Amendment, merchants would typically see debit card fees as 2% plus $0.40 ISO or aggregator). per transaction.

Fintech Finance

DECEMBER 13, 2023

The PSR is proposing to introduce a price cap to protect UK businesses from overpaying on these interchange fees. Subject to the PSR’s final report and further consultation on remedies, this could happen in two stages: An initial time-limited cap of 0.2% for UK-European Economic Area (EEA) consumer debit transactions and 0.3%

Stax

JULY 30, 2024

However, before implementing it, you must know all the state, federal, and card network rules surrounding it. Surcharges can only be applied to recoup some or all of the costs of allowing credit card purchases. Surcharging does not apply to debit cards even if they are used as credit cards.

PYMNTS

OCTOBER 14, 2020

On the plus side, Wells Fargo reported that card fees rose to $912 million in the third period, up from $797 million in second quarter. Wells Fargo also saw heightened debit card usage during Q3. Debit card point-of-sale purchase volume hit $102.9 billion in the period, up 11.1 percent from a year ago.

Payments Source

FEBRUARY 14, 2017

lawmakers to consider easing capital requirements and repealing part of the Dodd-Frank financial overhaul that caps fees banks charge retailers on debit-card transactions. Chief executives at the biggest U.S. regional banks are asking U.S.

PYMNTS

SEPTEMBER 8, 2017

A new study has found that the number of payment cards issued globally reached 14 billion last year and is predicted to rise to 17 billion by 2022, boosted by an increase in overall debit card issuance. For many, a debit card will normally be the first card they receive when they enter the banking system.

Stax

DECEMBER 20, 2023

Debit card transactions generally have lower interchange fees compared to credit card transactions. This is because debit cards are linked directly to the customer’s bank account, and the risk of non-payment or default is lower. For a $100 transaction, a swiped Mastercard debit card will cost you around 27¢.

Electronic Payments Coalition

JANUARY 17, 2024

CRS, whose mission is to offer research and analysis to Congress, echoed an earlier report by the Richmond Federal Reserve noting that consumers failed to see any meaningful cost savings as a result of similar legislation imposing routing mandates and price caps on debit card interchange.

The Fintech Times

JANUARY 28, 2025

.” Since 2015, UK law has capped the level of MIFs at 0.3 per cent for consumer credit card transactions. These capped fees, however, exceed the competitive level of charge. is unlawfully overcharged by Mastercard and Visa on payments made by credit and debit cards. For every 100 transaction, up to 0.30

The Fintech Times

DECEMBER 15, 2024

To ensure this doesn’t continue, it has proposed a consultation to price cap remedy to protect firms. per cent for debit cards and 0.3 per cent for credit cards over the course of 2021 and 2022. The PSR is consulting on whether to introduce a short-term, interim cap on fees and if so, at what level.

Electronic Payments Coalition

FEBRUARY 7, 2024

Since Congress introduced price caps and routing mandates on debit cards in 2011, research from independent and government sources has illuminated their disproportionate negative impact on small businesses.

PYMNTS

DECEMBER 2, 2020

Virtual card numbers can’t be copied, and their spend controls make overspending or unauthorized spending “virtually” impossible. For these and other reasons, virtual cards are suddenly hot, as Kelley Knutson, president of prepaid debit card provider Netspend, told PYMNTS.

Neopay

AUGUST 22, 2024

European banks have expressed “serious concerns” regarding the UK Payment Systems Regulator’s (PSR) plan to cap interchange fees on cross-border digital transactions. They warn that the proposed cap could lead to losses on transactions due to the increased costs associated with digital wallets like Apple Pay and Google Pay.

Clearly Payments

MARCH 31, 2025

81% of small businesses accept credit and debit cards, while 37% accept digital wallets such as Apple Pay and Google Pay. Some states have pushed for regulatory action to cap these fees or introduce surcharge transparency requirements. Debit and credit card acceptance stands at 89%. In the U.S., In the U.S.,

PYMNTS

SEPTEMBER 26, 2016

The high fees charged by private firms that are hired by the courts to operate e-filing systems and that are often passed onto consumers who pay with a credit card have been capped by a bill approved by California Governor Jerry Brown on Sept.

Clearly Payments

AUGUST 14, 2024

North American payment processing fees are the highest in the world due to a combination of factors, including high interchange rates , which can exceed 2% per transaction, and the dominance of major card networks like Visa and Mastercard that control over 80% of the market. Unlike Europe, where interchange fees are capped at 0.3%

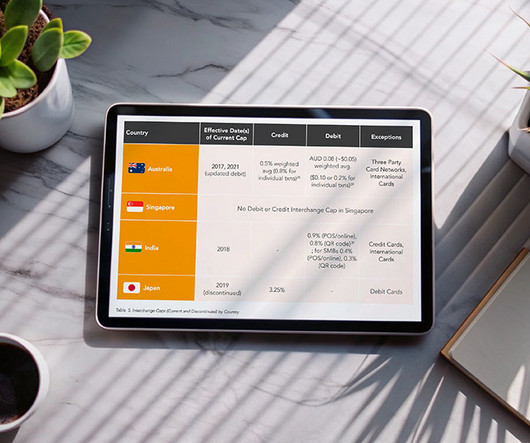

Fintech News

SEPTEMBER 17, 2024

A new report by CMSPI, an American payment consultancy, produced in collaboration with Amazon, explores payment trends and regulations in Asia-Pacific (APAC), focusing on the impact of rising card fees on merchants and the regulatory responses to these challenges. The move led to a notable decrease in the cost of acceptance for merchants.

PYMNTS

NOVEMBER 12, 2020

In mid-October, Wells Fargo reported markedly lower third-quarter earnings , but noted that credit card usage had climbed due to increased consumer spending. Credit card fees rose $912 million during the third quarter, up from $797 million in the second quarter. Wells Fargo also reported heightened debit card usage.

The Fintech Times

MARCH 19, 2025

There are now 149 million contactless cards in circulation, covering 93 per cent of debit cards and 94 per cent of credit cards.

Clearly Payments

APRIL 16, 2024

The two countries also have some big differences on how payment processing fees work across debit cards and credit cards. An Overview of Interchange Rates Interchange rates are often referred to as swipe fees or credit card fees. Interchange rates also exist for debit cards in the USA, but not in Canada.

Electronic Payments Coalition

FEBRUARY 28, 2024

WASHINGTON, DC — It’s been nearly 15 years since the Durbin Amendment imposed price caps and routing mandates on debit cards, financially burdening small businesses, while corporate mega-stores, like Walmart and Target, have accumulated substantial revenue gains.

PYMNTS

NOVEMBER 17, 2020

One approach to steering clear of large outflows would entail placing a cap on how much central bank digital currency (CBDC) one entity can have, according to Hiromi Yamaoka, per the report. Choosing to release the Amon debit card with UnionPay will make it easier for us to expand globally,” the company said in the announcement.

Payments Source

MAY 25, 2017

Known as the Durbin Amendment, the measure was included in the 2010 Dodd-Frank Act to limit how much money banks can charge retailers when consumers use their debit cards. Big-box retailers have beat back banks’ latest attempt to kill a legislative provision that has cost lenders billions of dollars in lost revenue.

PYMNTS

JANUARY 22, 2019

As it stands, the interchange fees charged to retailers when customers use a credit or debit card can differ from one country to the next in the European Union, presenting an opportunity, in theory, for retailers to shop around for a lower fee. percent fee on non-EU debit card payments done in shops, and a 0.3

Neopay

DECEMBER 18, 2023

The PSR is proposing to introduce a price cap to protect UK businesses from overpaying on these interchange fees. Subject to the PSR’s final report and further consultation on remedies, this could happen in two stages: An initial time-limited cap of 0.2% for UK-European Economic Area (EEA) consumer debit transactions and 0.3%

Payments Source

APRIL 24, 2016

It didn't take long for debit card issuers affected by the Durbin amendment fee caps to cut back or eliminate rewards programs to recoup costs. Issuers now engaged in the increasingly competitive credit card rewards and loyalty environment may soon have to face that same decision.

Stax

FEBRUARY 28, 2024

Can Credit Card Surcharges Be Passed to Customers Using a Debit Card? Surcharge fees cannot be added to debit card transactions or prepaid cards. This makes debit cards one of the alternative forms of payment your customers could select. Q: What is the maximum credit card surcharge?

Stax

DECEMBER 6, 2023

This additional fee is intended to cover the costs associated with processing credit card payments. Businesses that choose to add surcharges can either charge a fixed flat fee or a percentage of the transaction amount with a cap on the total. One exception is in Colorado where the cap is 2% or the cost of the merchant processing fee.

PYMNTS

MAY 26, 2017

Banks particularly like the caps for the billions in revenue they say the limits have cost them — but retailers have aggressively counter-lobbied that their businesses would be harmed without the limits Durbin created. Visa and Mastercard set the debit card fees — but the funds from them mostly flow to banks.

Stax

SEPTEMBER 26, 2024

That said, you can’t just decide and impose credit card surcharges overnight. It requires stringent adherence to regulatory guidelines and card network rules, from surcharge caps to disclosure requirements. Credit card networks like Mastercard and Visa set a universal limit of 4% on these fees.

PYMNTS

OCTOBER 7, 2016

The cash payout limit is capped at 1,000 Mexican pesos (approximately $50) per user, per day. Larger payouts are credited into debit cards of major banking providers, as well as OXXO’s Saldazo debit card. We continue to execute on our strategy to attract ‘Main Street’ and ‘High Street’ brands to serve customers.”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content