Demand for credit cards climbed this year

Payments Dive

NOVEMBER 22, 2022

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

NOVEMBER 22, 2022

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

Payments Dive

MARCH 5, 2024

The Consumer Financial Protection Bureau finalized a rule that sets a “threshold” of $8 for late fees that can be imposed by large credit card issuers, and eliminates automatic inflation increases.

Basis Theory

NOVEMBER 13, 2023

How Credit and Debit Cards Compare The fundamental difference between a credit and debit card is whose money is being used in the transaction: with a credit card, the consumer is borrowing from the card issuer , while with a debit card they are using their own money, stored with the issuing bank.

EBizCharge

AUGUST 22, 2024

As consumers increasingly rely on digital transactions, they may face the frustrating experience of a declined credit cards. What are credit card decline codes? What are credit card decline codes? Common reasons for declines include insufficient funds, an expired card, or surpassing a credit limit.

Payment Savvy

JANUARY 11, 2023

If you are one of the ten million-plus American businesses with a merchant processing credit card account, the chances are you are aware of an industry term known as interchange. Each new credit card transaction is assigned to what is known as a target interchange category. Interchange Downgrade.

Payments Dive

OCTOBER 14, 2024

The London-based consumer bank will issue two GM credit cards in the U.S., beginning next summer.

Payments Dive

MARCH 24, 2023

The agency wants to give consumers more information from credit card issuers so that it’s easier to compare the cards’ offers, especially their interest rates.

Stax

SEPTEMBER 26, 2024

Credit card surcharges are increasingly becoming a fact of life. Industry data shows that 9 out of 10 credit card users say they don’t want to pay surcharges but do it anyway. That said, you can’t just decide and impose credit card surcharges overnight. Learn More What is a Credit Card Surcharge?

Stax

APRIL 18, 2024

Accepting credit card transactions is no longer a decision of whether to but rather how to. With cashless now BEING king, credit and debit cards are the primary method for your customers to make payments. of consumer payments came through card payments. Card Network (e.g., Pre-pandemic, 62.3%

Payments Dive

AUGUST 24, 2022

The Consumer Financial Protection Bureau is considering requiring top credit card issuers to share more information on their products to increase transparency for consumers.

Fintech News

JUNE 12, 2024

In the rapidly evolving digital landscape, traditional credit cards face the challenge of staying relevant amidst the rise of digital wallets and changing consumer expectations. The emergence of Cards-as-a-Service (CaaS) offers a transformative solution that can help credit cards adapt and thrive in this new era.

Fintech Finance

JUNE 3, 2024

CorServ , a company empowering banks and fintechs with payment programs, has partnered with Pinnacle Bank ($2 billion in assets) to launch a comprehensive credit card program for its commercial, business and consumer customers. Pinnacle Bank, headquartered in Elberton, GA, has been locally owned since 1934.

Stax

DECEMBER 20, 2023

Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business. Request Quote What Are Interchange Fees?

EBizCharge

AUGUST 30, 2024

Navigating the complexities of credit card processing fees is a significant challenge for merchants in today’s digital economy. What are credit card processing fees? Credit card processing fees are fees merchants must pay to accept credit card payments from their customers.

Stax

JANUARY 10, 2024

Credit card transactions have quickly become the lifeblood of eCommerce businesses and storefronts alike. According to Capital One, global credit card transactions in 2022 reached an estimated 678 billion —an average of 1.86 However, accepting credit cards does come with a flipside; the ongoing sting of credit card fees.

Finextra

MARCH 5, 2024

The Consumer Financial Protection Bureau (CFPB) finalized a rule today to cut excessive credit card late fees by closing a loophole exploited by large card issuers.

Payments Source

MAY 13, 2020

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

The Fintech Times

MAY 11, 2024

O3 Capital , a Nigerian fintech and non-bank credit card issuer, is set to begin issuing four new American Express credit cards, serving local consumers and SMEs alike. American Express is excited to continue to strengthen its presence in Nigeria and expand its reach across Africa.

Electronic Payments Coalition

MAY 8, 2024

On Monday, the Electronic Payments Coalition released a new report examining how American consumers, including lower-income consumers, utilize reward credit cards and how proposals restricting card issuers’ ability to offer reward credit cards would adversely impact cardholders of all incomes.

EBizCharge

AUGUST 12, 2024

As digital transactions dominate the market, understanding the mechanics of credit card processing becomes essential for businesses and consumers. Merchant acquirers , also known as acquiring banks, are responsible for setting up and maintaining merchant accounts, allowing businesses to accept payment cards from customers.

FICO

JANUARY 24, 2023

FICO’s latest market report of UK card trends suggests that consumers managed their credit card debt to keep lines of credit open for the festive season as spend increased month on month. percent higher than October 2022 at £755 The percentage of consumer payments to balance dropped by 2.8 percent to 39.3

Tearsheet

AUGUST 28, 2024

Barrett Smith is the Chief Payments and Customer Operations Officer at Versapay Virtual credit cards are quickly becoming a key part of the B2B payment industry. In fact, the North American virtual card market is expected to grow 24% annually, hitting $694 billion by 2026. But first, a quick refresher on virtual credit cards.

FICO

NOVEMBER 10, 2020

I am always glad to see headlines like this one, which ran last summer in The New York Times: “ How to Reduce Credit Card Fraud.” In addition to these core technologies, banks and card issuers have large fraud teams dedicated to investigating individual customer claims, as well as monitoring trending fraud patterns.

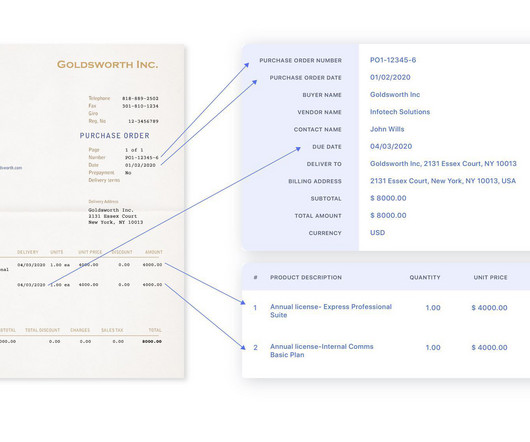

Nanonets

JUNE 24, 2024

What is Credit Card Reconciliation? Credit card reconciliation is the process of ensuring that the credit card transactions match the internal general ledger. It involves verifying the expenses recorded by the company's accounting system align with the statements provided by the credit card issuer.

Fintech Finance

SEPTEMBER 10, 2024

Issuer processing powerhouse Enfuce today announces the expansion of its E2 card to the UK, France and Germany, in collaboration with Mastercard. Offering debit and credit PANs in one card, E2 bolsters the company’s track record of delivering cutting-edge products that benefit both card issuers and customers.

Stax

JANUARY 15, 2024

Are you struggling with resource constraints caused by soaring credit card processing costs? Credit card surcharging can help offset these expenses, but it can be tricky. TL;DR Credit card surcharging involves adding a fee to transactions with credit card payments, offsetting processing costs.

Payments Source

SEPTEMBER 1, 2020

Capital One Financial is reining in credit lines to reduce its exposure while the nation’s largest card issuer, JPMorgan Chase, is rolling out a new card designed for travelers and diners.

PYMNTS

OCTOBER 24, 2018

Synchrony Financial’s run as the exclusive credit card issuer for Walmart came to an end in July, with reports that Walmart decided this past summer to switch to Capital One Financial.

Fintech News

JUNE 12, 2024

In the rapidly evolving digital landscape, traditional credit cards face the challenge of staying relevant amidst the rise of digital wallets and changing consumer expectations. The emergence of Cards-as-a-Service (CaaS) offers a transformative solution that can help credit cards adapt and thrive in this new era.

Fintech Finance

AUGUST 2, 2024

The largest credit card issuer in the U.S., This partnership also provides access to a complimentary DashPass membership for existing Chase cardmembers and consumers who sign up now through December 31, 2027. Chase and DoorDash , the premier local commerce platform announced an extension and expansion of its partnership.

Stax

DECEMBER 6, 2023

In an era defined by digital transactions and cashless payments, the process of paying for goods and services is more convenient, and increasingly reliant on credit card transactions. However, as the popularity of credit cards and digital wallet payments continues to surge, the costs associated with accepting them also do.

M2P Fintech

AUGUST 8, 2023

The credit card industry in India is booming. crore* credit cards in circulation, a substantial jump from 7.5 But only 5%** of the population has a formal credit card. This is a huge opportunity for credit card issuers. Currently, there are 8.5 crore just a year ago.

FICO

OCTOBER 12, 2021

Eight-year high for increasing spend on UK cards. The average spend on UK credit cards increased £23 to £711 in August 2021. The change in consumer behaviour over the last 12 months is also illustrated in a 25 percent increase since January 2021 in average sales on credit cards. by Stacey West.

The Fintech Times

NOVEMBER 11, 2024

More than one-fourth (29 per cent) of bank customers and 22 per cent of credit card customers have experienced some instance of fraudulent activity on their accounts in the past 12 months alone, according to a new study by J.D. Power , the consumer intelligence company. The inaugural J.D. ” J.D. . ” J.D.

Electronic Payments Coalition

FEBRUARY 28, 2024

Now, Senators Dick Durbin and Roger Marshall are looking to do the same to Americans’ credit cards. Yet, rather than taking responsibility for their role in driving inflation, corporate mega-stores are shifting blame while profiting from consumers’ expenses.

PYMNTS

JANUARY 28, 2021

One of the more notable differences is their tendency to favor credit cards online and other options such as digital wallets over debit cards. PYMNTS’ latest research report, Online Security And The Debit-Credit Divide , a PYMNTS collaboration with Elan based on a survey of 2,466 U.S.

Bank Automation

JUNE 4, 2024

The new Consumer Financial Protection Bureau rule putting buy now, pay later providers in the same category as credit card issuers can fuel the industry’s growth, experts say.

Fintech Finance

FEBRUARY 20, 2024

The merger marks a significant milestone in the payments industry, promising enhanced value for consumers and reshaping competitive dynamics. This all-stock transaction unites two of the nation’s leading credit card issuers, setting the stage for the creation of a robust payments network capable of competing on a global scale.

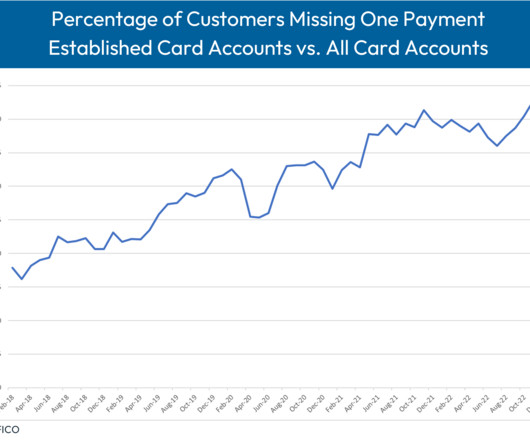

FICO

APRIL 19, 2023

Home Blog FICO UK Credit Cards: Are "Established" Accounts in Trouble? The percentage of Established UK credit card accounts with two missed payments is more than 83 percent higher than all account vintages. The percentage of Established UK credit card accounts with three missed payments is nearly 94 percent higher.

PYMNTS

APRIL 26, 2020

Banks are bracing for fallout as more people struggle to make credit card payments due to lost paychecks amid the coronavirus pandemic, according to a report by The Wall Street Journal (WSJ). Credit card companies — Capital One, Discover, Synchrony — have been allowing people to pause payments for 30 days or more.

PYMNTS

SEPTEMBER 29, 2020

Marqeta , the global card issuing platform, debuted its new Tokenization-as-a-Service (TaaS) product, which allows card issuers to access its tokenization technology, the Oakland, California-based company announced on Tuesday (Sept. The global financial services company joined with Marqeta to issue virtual cards.

PYMNTS

APRIL 27, 2020

As consumers shop amid ongoing public health restrictions, they almost invariably reach for their credit cards — whether the physical varieties in their wallets or the digital versions stored on their browsers and mobile devices. More than ever, credit cards are becoming the coin of the realm in the global connected economy.

Electronic Payments Coalition

OCTOBER 16, 2023

The Electronic Payments Coalition (EPC) released a new explainer document highlighting why retailers and their trade associations have historically pushed for greater usage of credit cards. Despite a recent campaign from some of the loudest voices in retail, credit cards have increasingly become the preferred option of commerce.

Payments Source

APRIL 26, 2017

All six big card issuers reported higher chargeoffs in their credit card businesses, a sign that the post-crisis era of exceptionally strong credit performance has run its course.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content