Demand for credit cards climbed this year

Payments Dive

NOVEMBER 22, 2022

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

NOVEMBER 22, 2022

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

Payments Source

JANUARY 8, 2021

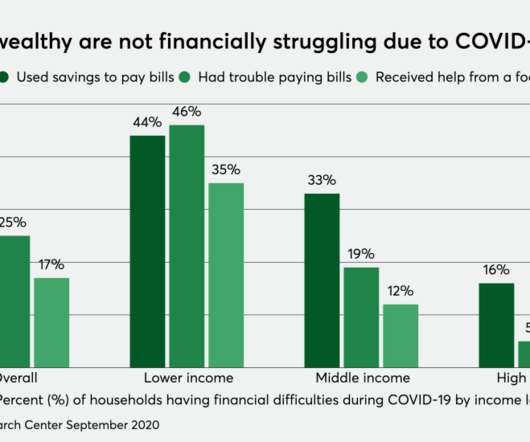

Credit card issuers also suffered, as demand lagged heavily for new cards and their overall spending dropped considerably during the year.

Payments Source

JUNE 5, 2019

Credit card issuers are wrong about why card balances are falling — fintechs are luring customers away, according to Wayne Best, Visa's chief economist.

Payments Source

MAY 13, 2020

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

Payment Savvy

JANUARY 11, 2023

If you are one of the ten million-plus American businesses with a merchant processing credit card account, the chances are you are aware of an industry term known as interchange. Each new credit card transaction is assigned to what is known as a target interchange category. Interchange Downgrade.

Stax

DECEMBER 20, 2023

Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business. Request Quote What Are Interchange Fees?

Payments Dive

MAY 24, 2024

The retail behemoth and its credit card issuer said in a terse, joint press release Friday that they’re parting ways.

Payments Dive

MARCH 5, 2024

The Consumer Financial Protection Bureau finalized a rule that sets a “threshold” of $8 for late fees that can be imposed by large credit card issuers, and eliminates automatic inflation increases.

Payments Source

MARCH 8, 2020

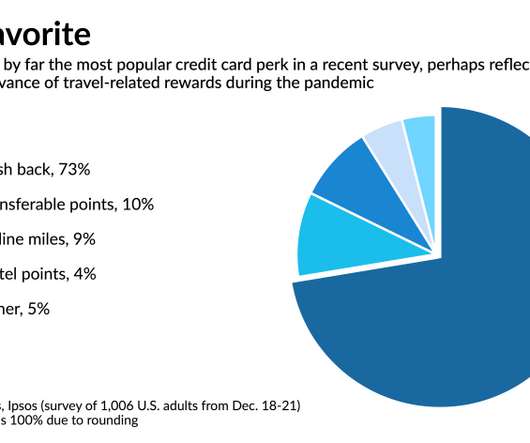

Credit card issuers caught in the trap of chasing new customers with increasingly costly rewards-point programs are trying something new: letting more users redeem rewards directly with merchants instead of acting as the intermediary.

Synapse Payment Systems

AUGUST 25, 2022

Almost every business accepts credit card payments these days. The good news is that it is possible to learn how to lower credit card processing fees. Here’s what you should know about negotiating lower credit card processing fees. Most credit card processing fees are between 2.5

Stax

DECEMBER 9, 2024

As consumers, most of us have looked at last month’s credit card statement and experienced the panic of not recognizing a charge. But credit card chargebacks also occur for a variety of other reasons and they’re not always honest. What Are Credit Card Chargebacks?

Paystand

OCTOBER 18, 2024

Table of Contents What is a credit card issuer? Who can be a credit card issuer? How do credit card issuers operate within the payment cycle? What do credit card issuers do? Eliminate credit card fees with Paystand

Payments Dive

JULY 6, 2023

senators, the top 10 credit card issuers outlined their late fee practices and warned of potential consequences if fees are capped as the CFPB has proposed. In responses to a group of U.S.

Payments Source

JUNE 5, 2019

credit-card issuer, is reviving a controversial policy that forces credit-card customers to use arbitration instead of court to resolve payment disputes. JPMorgan Chase & Co., the biggest U.S.

Fintech News

JUNE 12, 2024

In the rapidly evolving digital landscape, traditional credit cards face the challenge of staying relevant amidst the rise of digital wallets and changing consumer expectations. The emergence of Cards-as-a-Service (CaaS) offers a transformative solution that can help credit cards adapt and thrive in this new era.

Clearly Payments

DECEMBER 2, 2024

With over 79% of consumers using credit or debit cards for transactions, businesses that do not accept cards risk losing significant sales. This article will explore the various ways businesses can accept credit cards, including their advantages, costs, and considerations. Transaction fees range from 1.5%

Payments Dive

MARCH 24, 2023

The agency wants to give consumers more information from credit card issuers so that it’s easier to compare the cards’ offers, especially their interest rates.

Payments Dive

NOVEMBER 8, 2018

A panel at the Money20/20 show cited progress in transaction protocols for mobile payments.

Payments Source

SEPTEMBER 1, 2020

Capital One Financial is reining in credit lines to reduce its exposure while the nation’s largest card issuer, JPMorgan Chase, is rolling out a new card designed for travelers and diners.

Basis Theory

NOVEMBER 13, 2023

How Credit and Debit Cards Compare The fundamental difference between a credit and debit card is whose money is being used in the transaction: with a credit card, the consumer is borrowing from the card issuer , while with a debit card they are using their own money, stored with the issuing bank.

Payments Dive

APRIL 20, 2023

Despite a somewhat troubled past with Walmart, the card issuer appears to be raising its hand if the retailer is looking for a new credit card partner.

Clearly Payments

JANUARY 12, 2024

Credit card fraud is an unfortunate reality that businesses must face in today’s digital age. Year after year, credit card fraud attempts are on the rise, with a staggering 46% year-over-year increase reported globally. Here are specific steps to take if a credit card fraud incident occurs.

Payments Dive

AUGUST 24, 2022

The Consumer Financial Protection Bureau is considering requiring top credit card issuers to share more information on their products to increase transparency for consumers.

Stax

APRIL 18, 2024

Accepting credit card transactions is no longer a decision of whether to but rather how to. With cashless now BEING king, credit and debit cards are the primary method for your customers to make payments. of consumer payments came through card payments. Card Network (e.g., Pre-pandemic, 62.3%

Stax

MAY 7, 2024

With credit card transaction volume hitting over $9.5 trillion in the US in 2022, accepting card payments is no longer a question of whether to, but how to. To complete payment processing, credit card companies have to charge processing fees. Cashless transactions have dethroned the age-old cash payments.

Payments Source

MARCH 25, 2020

Alliance Data Systems, which has substantial exposure to the mall-based retail sector, sought Tuesday to assuage investors' fears about the impact of the COVID-19 outbreak.

Stax

JANUARY 10, 2024

Credit card transactions have quickly become the lifeblood of eCommerce businesses and storefronts alike. According to Capital One, global credit card transactions in 2022 reached an estimated 678 billion —an average of 1.86 However, accepting credit cards does come with a flipside; the ongoing sting of credit card fees.

FICO

NOVEMBER 10, 2020

I am always glad to see headlines like this one, which ran last summer in The New York Times: “ How to Reduce Credit Card Fraud.” In addition to these core technologies, banks and card issuers have large fraud teams dedicated to investigating individual customer claims, as well as monitoring trending fraud patterns.

Stax

NOVEMBER 21, 2024

Whether you are starting a new online store or looking to grow your existing brick-and-mortar small business, you must make provisions for accepting credit card payments. In this article, you will discover all you should know about credit card payment processing for small businesses.

Clearly Payments

OCTOBER 22, 2024

This guide explains how a PIN functions in credit and debit card payments and its importance for merchants. A PIN is a four- to six-digit numerical code assigned to a credit or debit card by the card issuer or chosen by the cardholder. What is a PIN? How Does a PIN Work?

PYMNTS

APRIL 26, 2020

Banks are bracing for fallout as more people struggle to make credit card payments due to lost paychecks amid the coronavirus pandemic, according to a report by The Wall Street Journal (WSJ). Credit card companies — Capital One, Discover, Synchrony — have been allowing people to pause payments for 30 days or more.

Stax

OCTOBER 21, 2024

Accepting credit card payments at your business is a surefire way of increasing customer satisfaction and retention. Over 80% of American adults owned at least one credit card in 2023. Also, credit cards contributed to 27% of the spending at point-of-sale (POS) systems worldwide. Don’t believe it?

PYMNTS

APRIL 27, 2020

As consumers shop amid ongoing public health restrictions, they almost invariably reach for their credit cards — whether the physical varieties in their wallets or the digital versions stored on their browsers and mobile devices. More than ever, credit cards are becoming the coin of the realm in the global connected economy.

PYMNTS

JANUARY 28, 2021

One of the more notable differences is their tendency to favor credit cards online and other options such as digital wallets over debit cards. PYMNTS research reveals that security is at the heart of distinctions between consumers’ attitudes toward using debit, credit or other options to pay online.

Finextra

SEPTEMBER 10, 2024

Finnish-founded card issuer and payment processor Enfuce is bringing its two-in-one debit and credit card to the UK, France and Germany.

Payments Source

MAY 24, 2019

Fintechs that offer installment loans are having a major impact on credit card lending — and many card issuers are ill equipped to compete.

Stax

SEPTEMBER 26, 2024

Credit card surcharges are increasingly becoming a fact of life. Industry data shows that 9 out of 10 credit card users say they don’t want to pay surcharges but do it anyway. That said, you can’t just decide and impose credit card surcharges overnight. Learn More What is a Credit Card Surcharge?

Payments Dive

AUGUST 14, 2024

The bank and credit card issuer told regulators in a letter that competition will require it to keep its products fairly priced.

Payments Dive

OCTOBER 14, 2024

The London-based consumer bank will issue two GM credit cards in the U.S., beginning next summer.

Payments Source

MARCH 22, 2021

Large banks that counted on airline and hospitality points to drive loan growth in the credit card business are anticipating renewed demand once safety concerns subside. But they’re also cautioning that the recovery in travel spending is likely to be gradual. ]].

Stax

JANUARY 15, 2024

Are you struggling with resource constraints caused by soaring credit card processing costs? Credit card surcharging can help offset these expenses, but it can be tricky. TL;DR Credit card surcharging involves adding a fee to transactions with credit card payments, offsetting processing costs.

Fintech Finance

SEPTEMBER 10, 2024

Issuer processing powerhouse Enfuce today announces the expansion of its E2 card to the UK, France and Germany, in collaboration with Mastercard. Offering debit and credit PANs in one card, E2 bolsters the company’s track record of delivering cutting-edge products that benefit both card issuers and customers.

Payments Source

MARCH 16, 2020

SBI Cards & Payment Services Ltd. declined in its stock market debut as investor uncertainty stemming from the coronavirus pandemic cast a shadow over the listing of India’s first pure-play credit card issuer.

Electronic Payments Coalition

FEBRUARY 28, 2024

WASHINGTON, DC — It’s been nearly 15 years since the Durbin Amendment imposed price caps and routing mandates on debit cards, financially burdening small businesses, while corporate mega-stores, like Walmart and Target, have accumulated substantial revenue gains.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content