Demystifying Credit Card Interchange Fees: What You Need to Know [2024 Rates and Updates]

Stax

DECEMBER 20, 2023

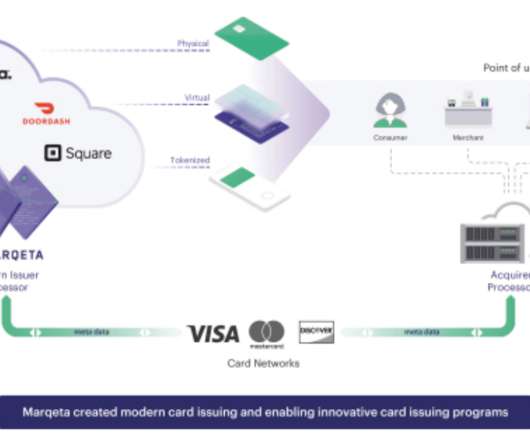

Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business. Request Quote What Are Interchange Fees?

Let's personalize your content