"Score a Better Future" Increases FICO Score Understanding

FICO

OCTOBER 11, 2019

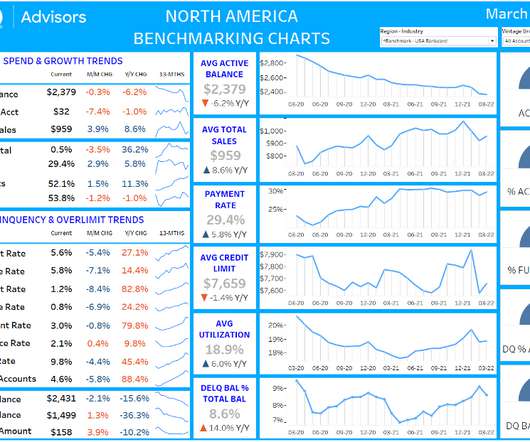

The area where the action of closing a credit card account may have impact on a FICO® Score is with evaluation of revolving account utilization. This is simply a ratio that looks at how much of your available revolving credit limits are being used. The higher revolving utilization percentage the greater the risk.

Let's personalize your content