Understanding Visa Plus: the Future of Money Transfers?

Fi911

APRIL 23, 2024

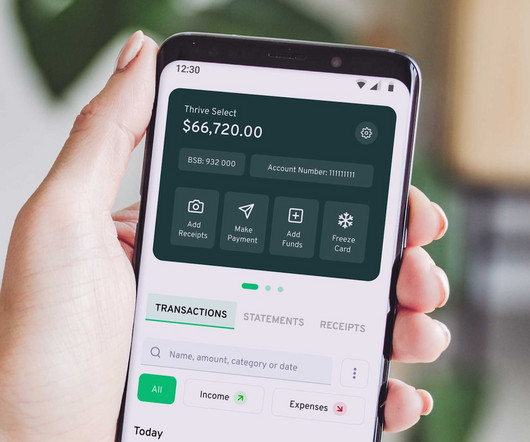

While this has brought about a plethora of options from PayPal to Venmo, it has also led to a fragmented ecosystem where interoperability has been a significant challenge. Users will create a unique Visa+ payname linked to their existing account on a participating platform such as PayPal or Venmo.

Let's personalize your content