Fed Exploring ‘Hypothetical’ Digital Currency

PYMNTS

AUGUST 14, 2020

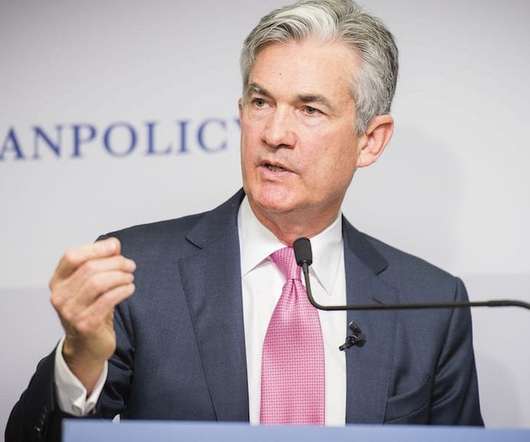

A week after details of the Federal Reserve’s instant payment initiative emerged, news came via Bloomberg that the central bank is working with the Massachusetts Institute of Technology (MIT) to explore the possibility of issuing digital currency. Legal issues include whether a CBDC would have status as legal tender.

Let's personalize your content