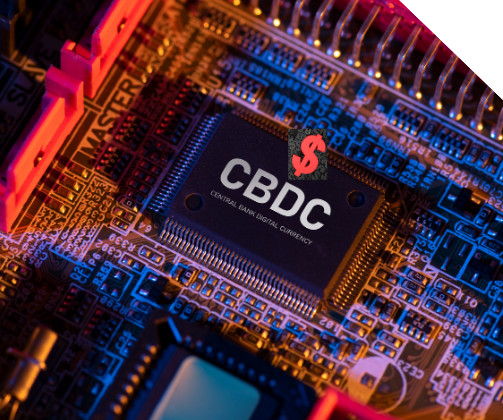

Banks push back against CBDC

Payments Dive

AUGUST 29, 2022

The nation’s biggest bank and bank trade groups stressed the risks of creating a central bank digital currency in comments to the Fed, and largely rejected the idea that a digital dollar would accomplish stated goals.

Let's personalize your content