US check use for payments exceeds other countries: Fed

Payments Dive

AUGUST 22, 2023

check use for transactions, other nations have seen sharper declines, a Federal Reserve study showed. Although there has been a drop in U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Checks Related Topics

Checks Related Topics

Payments Dive

AUGUST 22, 2023

check use for transactions, other nations have seen sharper declines, a Federal Reserve study showed. Although there has been a drop in U.S.

Payments Dive

JULY 10, 2024

The retailer’s customers will still have six payment options after the change takes effect in about a week.

Payments Dive

AUGUST 19, 2024

Oddly enough, that has been accompanied by a rise in check fraud. Electronic payments have become the norm for most B2B transactions. Here's what businesses need to know.

Fintech Finance

SEPTEMBER 24, 2024

Codat , the leading business data and insights provider for banks, has released new data that reveals a vast majority (71%) of US mid-sized businesses still use paper checks for supplier payments. Check fraud nearly doubled between 2021 and 2022, and more than $24 billion will be lost to check fraud in 20241.

Advertisement

Many application teams leave embedded analytics to languish until something—an unhappy customer, plummeting revenue, a spike in customer churn—demands change. But by then, it may be too late. In this White Paper, Logi Analytics has identified 5 tell-tale signs your project is moving from “nice to have” to “needed yesterday.".

Stax

NOVEMBER 11, 2024

ACH payments use the same information as a paper check , but with additional benefits which have been diverting users away from traditional check writing. Here, we’ll discuss the main differences between ACH and check payments and the business benefits of accepting this form of payment.

Payments Dive

OCTOBER 8, 2024

“The persistence of paper checks for patient refunds is not just an inconvenience — it's a symptom of a larger problem that threatens the very sustainability of healthcare organizations,” one software firm CFO writes in this opinion piece.

Bank Automation

SEPTEMBER 3, 2024

Chase customers claimed to have identified a glitch in Chase ATMs during Labor Day weekend, allowing them to deposit false checks and withdraw large sums of cash from accounts potentially without the funds to cover the withdrawals. This past weekend, Chase clients took to TikTok to share “the glitch” in the $3.8

Fintech Finance

OCTOBER 9, 2024

and CBI joins their IBAN-Name Check expertise at the service of their respective communities in order to offer an interoperable solution to fight against fraud. The IBAN Name Check – VoP Service, is designed to ensure that IBAN codes are correctly matched with the names of beneficiaries before payments are processed. SEPAmail.eu

Speaker: Shaunna Bruton - Associate Director of Product Strategy at Orium | Sam Panzer - Director of Industry Strategy at Talon.One | Frank Passantino - Director of Product Management at Bloomreach

In this session we’ll cover: A pulse check on retailers’ priorities heading into 2024 Cross-channel personalization and cracking frictionless omnichannel CX AI and the potential for personalization Our recommendations based on the state of the industry Don’t miss out and sign up today!

National Processing

JULY 26, 2024

National Processing Check 21 vs ACH: Key Differences and Which One Fits Your Business A merchant or business trying to decide the best electronic payment processing system may be interested in the differences between Check 21 and ACH.

Fintech Finance

SEPTEMBER 17, 2024

Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth, announced that Affirm is now available to eligible users checking out online and in-app with Apple Pay on iPhone and iPad. After choosing Affirm, they will go through a quick eligibility check that will not impact their credit score.

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

Payments Dive

SEPTEMBER 4, 2024

Some customers deposited bad checks and immediately withdrew funds before the checks bounced in a glitch that went viral on TikTok. Now, some users have holds on their accounts.

Payments Dive

MAY 29, 2024

Roughly 72% of consumers say they swipe, dip or tap a debit card at the point of sale, a larger portion than credit cards, checks and digital wallets, according to a consumer survey by research firm J.D.

Payments Dive

SEPTEMBER 14, 2023

The run-up in labor costs at Fidelity National Information Services has eased, and the paytech services company is eyeing AI to keep them in check.

VISTA InfoSec

MAY 24, 2024

It is done to check whether only allowed data traffic is allowed between the card and the card and non-card data networks. It is done to check if the card data is secure and there are no data leakages. Note: If you are a Service Provider then it will be done twice every six months under Requirement 11.3.4.1. of PCI DSS. of PCI DSS.

Payments Dive

SEPTEMBER 25, 2023

Quick Checkout for Adobe Commerce powered by Bolt helps merchants streamline the checkout process and allows shoppers to check out with one click.

Fintech News

OCTOBER 28, 2024

By enabling transactions to pass necessary checks before proceeding, Mandala offers a streamlined approach to international payments, ensuring they remain compliant while improving efficiency. It enhances transparency and provides real-time reporting and monitoring capabilities for regulatory bodies.

Stax

JULY 9, 2024

From a consumer’s perspective, that means any transaction that doesn’t need a physical credit card, debit card, prepaid cards, or checks. Digital payments feature a multitude of benefits including: Digital payments streamline transactions by eliminating the need for physical handling of cash or checks.

VISTA InfoSec

MARCH 5, 2024

Suggests observing login attempts on random systems as a check. Specific checks about use of visitor badges in the cardholder data environment. Same principle but adapted to check procedures across the CDE. Streamlined approach: document review to see if procedures exist, plus an interview check on backup site security.

Finextra

JUNE 18, 2024

Bank-to-bank payment messaging network Swift is working to facilitate interoperability of Verifcation of Payee schemes across Europe as new research shows that 83% of SMEs across France, Germany, Italy and Spain rank upfront beneficiary checks as important to them in trading across borders.

Finextra

OCTOBER 22, 2024

On the second day of Sibos, Benedicte Nolens, centre head of the BIS Innovation Hub moderated the session ‘Reality check: How far have CBDCs come?’, and the speakers outlined how central bank digital currencies (CBDCs) are in various processes of development in their countries.

Stax

DECEMBER 12, 2024

To choose a merchant service provider, compare pricing structures, review contract terms, check system compatibility, and prioritize responsive customer support. Check its scalability and security capabilities too to support your future growth. Check processing. It can also help minimize errors and risks of bounced checks.

VISTA InfoSec

JULY 17, 2024

Then, check everything again. Outline regular audit processes to check compliance with these policies. Next, make checking for dangers a regular part of everyone’s job , not just the IT department’s work. Use experts who know both languages well and understand cybersecurity inside out.

Fintech Finance

OCTOBER 31, 2024

Today, the Payment Systems Regulator (PSR ), marks another significant milestone in its fight to tackle fraud, as hundreds of additional financial firms adopt the name-checking service, Confirmation of Payee (CoP). billion checks have been completed. Since its launch in 2020, more than 2.5

The Fintech Times

FEBRUARY 21, 2024

But when it comes to application and onboarding, they must be sure those protections, fraud checks and identity proofing are appropriate, proportionate and time-efficient to reduce the chance of dropouts.” Almost one in five will abandon an application if the checks are too difficult or take too long.

Nanonets

APRIL 30, 2024

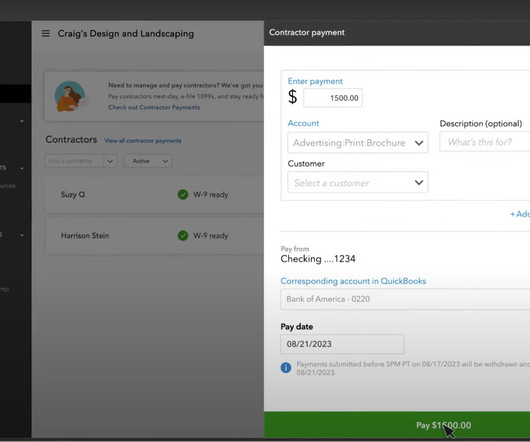

QuickBooks offers a range of contractor payment options, but the base QuickBooks Online platform lets users quickly pay contractors via direct deposit and check. After filling in all details, hit 'Save' Paying Contractors via Check If your contractor is local or prefers paper checks, doing so is easy in QuickBooks Online.

Electronic Payments Coalition

MARCH 11, 2024

Below are fact-checks that set the record straight about the harm caused by credit card routing mandates. The post A Guide to Meeting with the National Association of Convenience Stores (NACS) This Week appeared first on Electronic Payments Coalition.

VISTA InfoSec

APRIL 5, 2024

But by doing regular check-ins, establishing key performance indicators (KPIs), and using project management software can ensure focus even if employees aren’t together in an office. The setup also enables flexibility to accomplish tasks whenever and wherever, as long as they finish the job.

BlueSnap

MARCH 15, 2024

Check your offerings against this complete list. Does your eCommerce business have enough payment methods to satisfy everyone? The post BlueSnap’s Ultimate List of Digital Payment Methods for Global Businesses appeared first on BlueSnap.

Finextra

SEPTEMBER 3, 2024

Three men have pleaded guilty to operating a subscription-based Web service in the UK that enabled criminals to circumvent One-Time-Passcode (OTP) anti-fraud checks.

VISTA InfoSec

MAY 12, 2024

Check POS Machines for Tampering One common tactic employed by data thieves is to attach data skimming devices onto legitimate POS hardware. While it’s still technically possible to process traditional swipe cards, malicious parties have found it easy to circumvent their security, which makes accepting them a clear risk.

TechCrunch Fintech

MAY 29, 2024

Owners of small- and medium-sized businesses check their bank balances daily to make financial decisions. But it’s entrepreneur Yoseph West’s assertion that there’s typically information and functions missing from bank accounts that owners could really use. “SMBs make up 44% of U.S.

The Payments Association

AUGUST 20, 2024

This article explores innovative strategies that can transform KYB (Know Your Business) checks from a routine compliance requirement into a strategic asset for Payment Service Providers (PSPs) in the Asia-Pacific region.

Fintech Finance

AUGUST 22, 2024

The interface enables the following features and benefits: Pre-authorisation transactions when guests check-in Incremental authorisations (Top-Up) during the stay. Automatically release authorisations if a guest wants to pay with a different card than the one provided at check-in. Purchase, refund and void transactions.

Fintech Finance

AUGUST 6, 2024

Biometric loyalty program check-in and payment provides a swift ordering and checkout experience for merchants and customers alike. PopID research has shown the platform decreases ordering and check out times by up to 90 seconds per transaction and can increase ticket size by 4 percent. The post J.P.

Fintech News

JUNE 13, 2024

The Logic/Syntax-based validation feature checks the length, structure, and check digits of bank details, providing information such as bank name, code, BIC code, and address, ensuring accurate and efficient payment processing.

Finextra

NOVEMBER 13, 2024

Viamericas, a leading licensed money transmitter known for its international money transfer, bill payment, check processing, and top-up services, is proud to announce the launch of its rapid cash-to-account transfer service in the United States.

Fintech Finance

OCTOBER 3, 2024

Numerated, the leading AI-driven commercial lending platform, today announced its partnership with Alloy, the identity risk management company trusted by over 600 leading banks, credit unions and fintech companies, to deliver best-in-class fraud checks within commercial lending.

Finovate

AUGUST 26, 2024

Be sure to check in with Finovate’s Fintech Rundown all week long for the latest in fintech news. As summer draws to a close, there may be a big acquisition on the horizon in the fraud and financial crime prevention space. Fraud and financial crime prevention Is Visa looking to acquire fraud fighting platform Featurespace ?

VISTA InfoSec

FEBRUARY 28, 2024

Check that the people in charge of these tasks understand their specific duties. Check your list of system/application accounts. Check that they have clear methods to avoid storing passwords within code. assessments.) Make sure these records outline who does what in terms of managing user accounts. Requirement 8.3.6:

Open Banking Excellence

NOVEMBER 7, 2023

It has the potential to quickly gain ubiquity at low cost, as it is based on the comprehensive customer due diligence checks already applied by banks to their 50 million customers. Bank-verified identity is faster and more secure than existing identity checks. This bank-centric form of digital identity already exists in the UK.

VISTA InfoSec

JANUARY 18, 2024

a Check system configuration standards to confirm that necessary services, protocols, and daemons are identified and recorded. We also encourage you to check out our previous and upcoming blogs on the changes in requirements from v3.2.1 This helps maintain a clean and secure system environment. in PCI DSS.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content