How EMV has grown beyond the chip on a card

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

Stax

MARCH 14, 2024

EMV (Europay, Mastercard, and Visa) chip card use has continued to expand in use since its tumultuous rollout in 2015. The EMV standard has now become a global standard for cards equipped with computer chips and the technology used to authenticate chip-card transactions.

PYMNTS

APRIL 2, 2019

Wells Fargo announced Tuesday (April 2) the launch of contactless consumer credit and debit cards. In a press release , Wells Fargo said the new cards will enable customers to complete transactions quickly and with a single tap at millions of merchants and transit systems that accept contactless payments.

Clearly Payments

OCTOBER 22, 2024

As a merchant, understanding how a PIN (Personal Identification Number) works with credit and debit card transactions is essential for running a secure and efficient payment process. This guide explains how a PIN functions in credit and debit card payments and its importance for merchants. What is a PIN?

PYMNTS

APRIL 11, 2019

Coinbase , the cryptocurrency exchange operator, announced Wednesday (April 10) the launch of the Coinbase Card in the U.K., which is a Visa debit card that lets customers in the U.K. Customers are able to use the card in millions of places around the world. In a blog post , Zeeshan Feroz, chief executive of Coinbase U.K.,

PYMNTS

SEPTEMBER 4, 2019

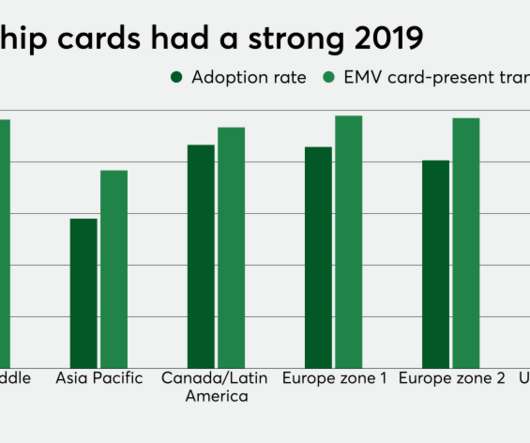

Visa announced that since their inception, chip cards have reduced counterfeit fraud by 87 percent. . Chip cards are increasingly becoming the norm as usage and acceptance has continued to grow since the EMV standard was first introduced in 2011,” the company said. Also down were overall card-present fraud rates.

Fintech Finance

OCTOBER 28, 2024

FV Bank, in partnership with Visa, has today announced at Money20/20 Las Vegas (October 27-30), the launch of FV Bank’s new debit cards and corporate expense cards. Businesses can order cards for authorized users, set individual spending limits, and track transactions in real-time through FV Bank’s platform.

PYMNTS

OCTOBER 16, 2018

16) that for the first time, contactless payments have become more popular than chip and pin card purchases when paying in-store in the U.K. The Guardian reported that Worldpay said it was the first time it has seen contactless payments surpass chip and pin. Worldpay, the payment technology company, announced Tuesday (Oct.

Stax

DECEMBER 20, 2023

Debit card transactions generally have lower interchange fees compared to credit card transactions. This is because debit cards are linked directly to the customer’s bank account, and the risk of non-payment or default is lower. For a $100 transaction, a swiped Mastercard debit card will cost you around 27¢.

CB Insights

AUGUST 2, 2018

One of the biggest trends in fintech today is the rise of digital banking products like mobile checking accounts and new debit cards. From Square to Paypal, a host of fintechs are creating products that let consumers spend money directly out of digital accounts using a physical card. get the 86-page fintech report.

Payment Savvy

JULY 3, 2024

Debit cards have become an indispensable part of our financial lives, with the majority of American adults, spanning all demographics, now possessing at least one debit card. Every merchant should prioritize taking the time to understand debit card processing to streamline operations and enhance customer satisfaction.

Fintech Finance

JUNE 18, 2024

Within this total: The number of contactless debit card transactions (1.364 billion) was 5.3 The number of contactless credit card transactions (225 million) was 9.3 This means contactless payments accounted for 76 per cent of all debit card transactions and 63 per cent of all credit card transactions made during March 2024.

FICO

MARCH 29, 2017

That means we’ll continue to see compromises - and card fraud - rise. As ATMs aren’t yet required to be chip-card enabled, the EMV adoption that came into force last year isn’t driving fraud down yet. The post Hacked ATMs Lead to 70% Rise in Debit Card Fraud appeared first on FICO. Follow me on Twitter @fraudbird.

PYMNTS

FEBRUARY 3, 2020

Fraudsters have grown adept at finding debit cards’ weak points, and merchants are struggling to keep up. Losses due to false credit and debit card declines — in which merchants reject legitimate orders on the mistaken belief that they are fraudulent — grew to $118 billion last year and are projected to reach $443 billion by 2021.

Fintech Finance

DECEMBER 12, 2024

When customers use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. On iPhone, simply open the Wallet app, tap +, and follow the steps to add credit or debit cards. Security and privacy are at the core of Apple Pay. Apple Pay is easy to set up.

PYMNTS

NOVEMBER 22, 2016

21) that its latest chip data update showed 388 million Visa EMV cards in the U.S. Of those, the firm said there are nearly 181 million chip credit cards in the field and 208.3 million chip debit cards. million chip-active locations across the country. Visa said Monday (Nov.

PYMNTS

FEBRUARY 13, 2019

Merchants saw a drop in card-present fraud due to the increased adoption of Europay, Mastercard and Visa (EMV) chip cards, Visa said. Merchants who have upgraded to chip technology saw a decrease of 80 percent in counterfeit fraud dollars in September of 2018 when compared to September of 2015. More than 3.1 More than 3.1

Clearly Payments

APRIL 16, 2024

The two countries also have some big differences on how payment processing fees work across debit cards and credit cards. An Overview of Interchange Rates Interchange rates are often referred to as swipe fees or credit card fees. Interchange rates also exist for debit cards in the USA, but not in Canada.

PYMNTS

DECEMBER 9, 2016

No longer are they focusing on credit and debit cards — those brazen attempts have been at least partly blunted by EMV and tokenization initiatives. Now, hackers are increasing efforts to pilfer personally identifiable information (or PII, for short).

PYMNTS

FEBRUARY 23, 2018

million merchant locations now accept chip cards, covering 59 percent of the merchant population. That latest tally also includes December of last year and represents a jump of 579 percent over the beginning of the migration to EMV chip card adoption in the United States. Debit cards numbered 272.7

The Paypers

AUGUST 15, 2017

(The Paypers) The 2017 Debit Issuer Study commission by PULSE has shown a decrease in debit fraud loss after US financial institutions increase issuance of chip debit cards in 2016.

Payments Source

JUNE 27, 2016

Kroger is suing Visa, alleging the network threatened to raise fees and cut off the supermarket chain from accepting its debit cards.

Payments Source

AUGUST 9, 2016

Three quarters of debit cards will have chips by the end of the year, but slow merchant adoption is limiting use, according to Pulse.

Payments Source

SEPTEMBER 13, 2016

New Orleans--As credit and debit card issuers start to see the benefits of EMV-chip card security, prepaid would seem to be the logical next step. But prepaid issuers remain unconvinced of the security benefits of EMV.

PYMNTS

DECEMBER 23, 2016

Credit and debit card payments are continuing to increase in terms of usage, with the Federal Reserve finding credit and debit card payments accounted for more than two-thirds of all noncash payments in the U.S. Among the key findings of the report was an increase of card payments to 19.9 from 2012 to 2015.

PYMNTS

AUGUST 29, 2018

merchants by 75 percent from September 2015 to March 2018 as more storefronts started accepting chip cards. To that end, Visa said that, as of its latest “Visa Chip Card Update,” as many as 67 percent of storefronts in the United States now accept chip cards. payments in June were on EMV cards.

PYMNTS

MARCH 27, 2017

As card swipes turned to chip insertions across the U.S., Recently, to combat long lines and payments fatigue, financial, merchant service and mobile payment company Square rolled out a firmware update to its chip payment terminals. According to data from ABI Research, annual shipments of contactless cards in the U.S.

PYMNTS

SEPTEMBER 15, 2020

Consider the fact that in Mexico it can take four to six months to open a business account — and as much as a year to get access to a debit card. As Poovala told Webster: “We had to get a debit card by actually creating our own startup. It’s been 20 months, and we tried to get a debit card from some of the largest banks.

PYMNTS

NOVEMBER 12, 2020

There’s also the safety of using debit in contactless payments, he said, where issuers had, fortuitously from a timing perspective, accelerated their issuance of contactless cards coming into 2020 and before the age of COVID-19.

PYMNTS

SEPTEMBER 2, 2016

The movement to EMV and chip cards has been one of safety, but card users themselves have been disgruntled when actually using the cards.

Fintech Finance

JUNE 17, 2024

When customers use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device nor on Apple servers. .” Security and privacy are at the core of Apple Pay.

Payments Source

MAY 24, 2016

Recently, Walmart filed a lawsuit against Visa complaining the company won't let it require PINs on transactions made with chip-enabled debit cards. There is an old saying by Mark Twain, "Never let the truth stand in the way of a good story, unless you can't think of anything better."

PYMNTS

MAY 17, 2017

The International Card Manufacturing Association (ICMA) is out with a new report that finds 70 percent of all financial cards have a chip embedded in them. In a press release issued Tuesday (May 16), the ICMA said chip cards account for 88.6 percent of revenue for cards globally manufactured in 2016.

PYMNTS

NOVEMBER 2, 2016

For banks and retailers, there is a fine line between making people’s use of credit and debit cards as painless as possible and protecting individuals’ financial details from swindlers. Contactless credit cards have seen a slow rate of adoption in the U.S., after being slow to be embraced by consumers.

PYMNTS

OCTOBER 14, 2020

When the chips are down, consumers love and trust their debit cards. Among clear COVID-era trends is the embrace of debit for managing and mastering new realities. Debit cards remain the payment method of choice among U.S. It’s all sunny news for debit brands and users, but there’s a caveat: it’s fraud.

PYMNTS

OCTOBER 14, 2019

In fact, almost 50 percent of all debit card payments are contactless. billion transactions with their debit cards, which is a jump of 8.9 billion card transactions, both debit and credit, made in July, an increase of 5.7 don’t rely on swiping or chip card readers. New data from U.K.

Payment Savvy

DECEMBER 2, 2022

Until recently, people made their credit and debit card payments with a bit of distrust because they were afraid of scammers stealing their card information through the card’s magnetic stripe. With NFC, you don’t need to insert a card and input a PIN. This is the most typical form of contactless payment.

The Paypers

OCTOBER 4, 2017

(The Paypers) Square has started to offer Interac debit cards for businesses using its point-of-sale system and also developed a contactless chip reader to facilitate the transactions in Canada.

Stax

JANUARY 5, 2024

TL;DR A credit card terminal is a device commonly used by businesses to handle credit and debit card transactions. Level Up Your Terminal with Stax Card Readers What is a Credit Card Terminal? A credit card terminal is a device commonly used by businesses to handle credit and debit card transactions.

PYMNTS

SEPTEMBER 29, 2016

Square announced earlier this week that businesses around Australia can access Square’s new contactless and chip card reader online at square.com.au It enables sellers to quickly and securely accept tap-and-go cards, mobile wallets, such as Apple Pay and Android Pay, and chip cards. for just $59.

FICO

FEBRUARY 16, 2023

As I mentioned in my last skimming post , consumers can pay close attention to PIN pads and payment terminals when using a credit card or a debit card. The least secure card payment method is swiping, as this will allow criminals with a skimmer in the terminal to capture all the card information from its magnetic strip.

Clearly Payments

MARCH 28, 2024

Clover Flex Clover Flex is a compact, portable credit card machine that offers a range of features suitable for various business types. It accepts a wide range of payment methods, including contactless, chip, and magnetic stripe cards. It accepts all major credit and debit cards, including tap, chip, and swipe payments.

PYMNTS

OCTOBER 14, 2019

In fact, almost 50 percent of all debit card payments are contactless. billion transactions with their debit cards, which is a jump of 8.9 billion card transactions, both debit and credit, made in July, an increase of 5.7 don’t rely on swiping or chip card readers. New data from U.K.

PYMNTS

NOVEMBER 23, 2016

22) that it is working to modify its debit routing policies, saying that it has “modified and clarified” its rules to boost EMV chip card adoption in the United States. Those modifications, the card giant said, come on the heels of guidance that has been issued by the Federal Reserve. Visa said Tuesday (Nov.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content