How EMV has grown beyond the chip on a card

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

JULY 8, 2020

The role of EMVCo — which is often seen as an extension of the card brands that deals only with chip-based EMV plastic cards— has come into sharper focus.

Payments Source

MARCH 15, 2021

After postponing enforcement for years, the card brands are implementing an EMV liability shift at fuel stations, which still struggle to make the upgrades necessary for chip-card acceptance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Tom Groenfeldt

MARCH 18, 2019

EMV chips have reduced POS card fraud as expected but fraudsters are moving into new areas such as opening new accounts in a stranger's name, taking over accounts or hitting reward programs for profits.

Payments Source

MAY 29, 2020

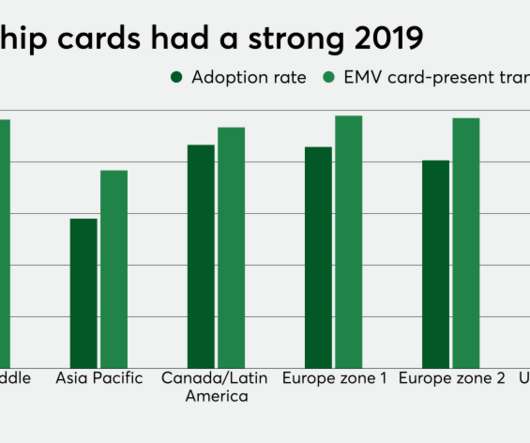

American financial institutions have surpassed 1 billion EMV chip cards in force to take second place in total EMV cards deployed, behind only the global leader, Asia Pacific.

Payments Source

OCTOBER 2, 2016

EMV chip cards have delivered on their promise to halt counterfeit fraud at the physical point of sale. But for a technology developed long before the invention of e-commerce, mobile wallets and the word "omnichannel," delivering on its promise still feels like falling short.

Payments Source

NOVEMBER 14, 2016

There are security gaps in chip cards that are vulnerable to new types of skimming. Biometrics can help solve this problem, and will also prove handy as EMV cards migrate to smartphones.

Stax

MARCH 14, 2024

EMV (Europay, Mastercard, and Visa) chip card use has continued to expand in use since its tumultuous rollout in 2015. The EMV standard has now become a global standard for cards equipped with computer chips and the technology used to authenticate chip-card transactions. What Types of EMV Chip Cards Are There?

Payments Source

APRIL 9, 2020

With the EMV liability shift date for automated fuel dispensers (AFD) looming, subject to any last-minute changes, we are seeing major changes at fuel sites across the USA. With close to 150,000 active fuel sites in the US alone, there are a huge number of individual pumps that will need to be upgraded to accept chip and PIN cards.

Payments Source

MARCH 17, 2016

Consumers who have been issued EMV chip cards know how to use them. So it might come as a surprise when merchants equipped with chip card readers instruct their customers to swipe their cards instead.

Payments Source

AUGUST 3, 2016

Visa announced Quick Chip four months ago, but until today the card brand has not had a place to showcase its faster EMV technology to merchants who feel burdened by the EMV payment process.

Payments Source

FEBRUARY 28, 2016

EMV liability shift for counterfeit card fraud went into effect, most restaurants aren't processing chip cards, and that's not changing anytime soon, according to a top executive at Heartland Payment Systems. Five months after the U.S.

Payments Source

JULY 20, 2016

The industry-led EMV Migration Forum is changing its name and expanding its focus to accommodate the myriad changes that are happening alongside the move to chip cards.

Payments Source

APRIL 13, 2016

migration to EMV chip technology – intended to reduce card fraud, provide global interoperability, and enable safer payment transactions – may prove to be a valuable move for more than just the payments industry.

PYMNTS

FEBRUARY 13, 2019

Merchants saw a drop in card-present fraud due to the increased adoption of Europay, Mastercard and Visa (EMV) chip cards, Visa said. Merchants who have upgraded to chip technology saw a decrease of 80 percent in counterfeit fraud dollars in September of 2018 when compared to September of 2015. More than 3.1 More than 3.1

Stax

NOVEMBER 14, 2024

EMV Smart Terminal Physical credit card processing terminals are great for businesses with brick-and-mortar locations to take in-person payments in-store. An important thing to remember is to make sure whatever machine you decide to purchase comes with full EMV and NFC technology enabled.

Payments Source

AUGUST 9, 2016

Card manufacturer Oberthur Technologies is offering issuers facing a shortage of EMV chip cards an option to receive as many as 25,000 in five days, rather than waiting the standard three to four weeks.

Payments Source

JULY 5, 2016

Merchants are facing consumer lawsuits stemming from the introduction of EMV-chip card security at the point of sale in the U.S., exposing the issues many stores must contend with now that they are held liable for fraud and chargebacks.

Payments Source

AUGUST 21, 2016

The promise of faster EMV technology is a welcome reprieve for many ISOs who have grown weary of listening to merchants gripe about the snail's pace of chip card transactions. That reprieve, however, may not be so quick in coming.

Payments Source

FEBRUARY 29, 2016

migration to EMV chip cards has been rough, according to U.K.-based based Creditcall, which hopes its new certification from First Data can smooth things out.

Payments Source

AUGUST 12, 2020

The complexity of the migration is an opportunity to examine other elements of the payment experience, says TNS' Brian DuCharme.

Payments Source

APRIL 6, 2016

Some retailers falsely think that if they are using EMV chip credit cards that they have eliminated any chance of security breaches at the register since the EMV approach is stronger than conventional credit cards.

Payments Source

DECEMBER 14, 2016

The percentage of EMV transactions in the United States is miniscule compared to other parts of the world, but the migration to chip cards in the U.S. is lifting the technology's global growth — now at 42.4% of all card transactions.

Payments Source

SEPTEMBER 12, 2018

EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

PYMNTS

SEPTEMBER 13, 2016

One year into the shift to chip-enabled cards — for the U.S., based consumer credit cards are chip cards, a tally that represents a 105 percent boost in chip card adoption since the liability shift took root on Oct. that is — Mastercard said on Monday (Sept. 1 of last year.

Payments Source

APRIL 13, 2016

Visa insists that EMV chip card transactions take no longer to process than magstripe transactions do, but it is aware that many consumers disagree.

Payments Source

MAY 18, 2020

In line with the other major card brands, Mastercard is extending its EMV liability shift at gas pumps to April 2021. It is also launching a data-driven fraud protection tool for fuel merchants who have not completed their upgrade to chip-card EMV pumps.

Payments Source

OCTOBER 6, 2016

For many restaurants that put originally put EMV on the back burner because of technical complexities and a lower general risk of counterfeit card fraud, waiting to support chip cards has proven to be the right decision.

PYMNTS

MAY 30, 2019

Visa said this week that as acceptance of EMV cards has gained traction in the U.S., EMV” is shorthand for Europay, Mastercard and Visa chip cards. million merchant locations now accept chip cards, which represents a 771 percent boost since U.S. storefronts now accept chip cards, according to the data.

Payments Source

APRIL 1, 2016

issued MasterCard consumer credit cards are now chip-enabled and the number of merchants accepting EMV transactions continues to climb, MasterCard said March 31. More than two-thirds of all U.S.-issued

PYMNTS

SEPTEMBER 4, 2019

Visa announced that since their inception, chip cards have reduced counterfeit fraud by 87 percent. . Chip cards are increasingly becoming the norm as usage and acceptance has continued to grow since the EMV standard was first introduced in 2011,” the company said. Chip cards are now accepted at more than 3.7

Payments Source

APRIL 3, 2018

KFC is finally converting its point of sale terminals to accept EMV chip cards, opting for a semi-integrated system to accept all payment types.

PYMNTS

NOVEMBER 22, 2016

21) that its latest chip data update showed 388 million Visa EMV cards in the U.S. Of those, the firm said there are nearly 181 million chip credit cards in the field and 208.3 million chip debit cards. million chip-active locations across the country. The total volume of chip-on-chip transactions across the U.S.,

PYMNTS

SEPTEMBER 19, 2016

As the payments industry nears the one-year anniversary of the United States’ transition to EMV, of course, it’s an opportune time to take stock of progress and what remains to be done. And that, he added, shows that merchants may have an EMV-capable PIN pad or reader but are not ready to deploy their countertop terminal in full EMV mode.

Payments Source

APRIL 21, 2020

The coronavirus pandemic has added a troubling twist to the already difficult process of converting fuel pumps to accept EMV chip cards and communicate with the stations' point-of-sale terminals.

Stax

MARCH 13, 2025

Security technology Additional security measures like EMV chip cards and contactless payments can both influence interchange fees. Since EMV chip transactions are harder to counterfeit, they often come with lower fees than traditional magnetic stripe payments. One way to do this is to encourage card-present transactions.

PYMNTS

DECEMBER 15, 2016

Collect for Stripe, a new app built by entrepreneur and developer Logan Thompson, was launched this week, enabling Stripe users to accept both swipe and EMV chip payments at brick-and-mortar locations using a tablet or mobile device.

Payments Source

APRIL 26, 2016

The hurdles to broader EMV adoption in the U.S. have many causes, but to the consumer the end result is typically the same: A longer payment process with no immediate gain.

Clearly Payments

MARCH 4, 2025

Lowering Cost with EMV Transactions One of the most effective ways to lower payment processing costs is by using EMV chip and PIN transactions. EMV technology not only enhances security but also helps businesses avoid higher processing fees associated with less secure payment methods, such as magnetic stripe transactions.

Payments Source

SEPTEMBER 27, 2016

is trying a new gambit offset consumers' irritation with hassles surrounding the messy EMV chip-card migration—it's introducing a winsome young woman to console the masses.

PYMNTS

SEPTEMBER 30, 2016

EMV: The three little letters that represent the single most hotly debated and discussed topic in the U.S. The walk to the liability shift in this market last October was technically four years long, but in reality, EMV didn’t become an absolute certainty until Dec. But it’s not just EMV. EMV is not only for the big guys.

Payments Source

JUNE 15, 2016

Despite some early success, it can’t be ignored that there are still many merchants that cannot accept EMV chip cards.

Payments Source

JUNE 14, 2016

Merchants and cardholders alike have been challenged by the perceived additional time to complete the EMV transaction. These concerns pushed both Visa and MasterCard to create a response to improve the speed of transacting: Visa's Quick Chip and MasterCard's M/Chip Fast.

Payments Dive

DECEMBER 2, 2019

With the October 2020 deadline for all pay-at-the-pump terminals to accept EMV chip cards looming, US gas stations are faced with a strategic revenue opportunity. Download this infographic from TNS which explores the results of a survey highlighting consumer willingness to embrace value added services at the pump.

Payments Source

SEPTEMBER 13, 2016

New Orleans--As credit and debit card issuers start to see the benefits of EMV-chip card security, prepaid would seem to be the logical next step. But prepaid issuers remain unconvinced of the security benefits of EMV.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content