The Silent Costs of a Traditional Financial Close (and Why It’s Time To Modernize)

FloQast

MARCH 25, 2024

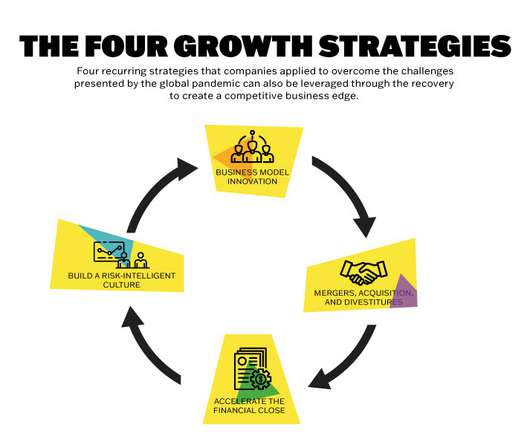

And solutions that are easy to implement help businesses mitigate the cost of traditional close processes and enhance performance. Automation can reduce the time to close by 26 % or more. This increases the time it takes to close and adds more pressure to workloads during this process. Take SOX as one example.

Let's personalize your content