Best Reconciliation Software

Nanonets

JUNE 13, 2024

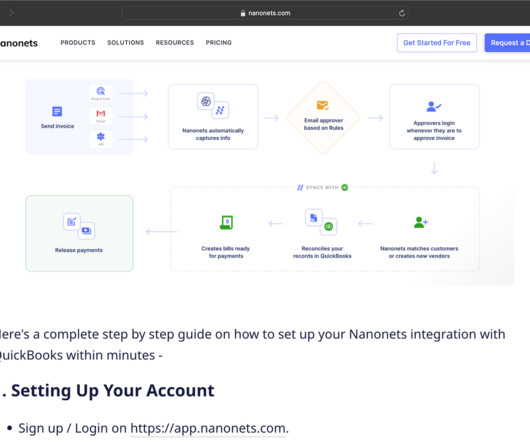

Timely completion of the financial close process helps stakeholders in decision making and reporting. By identifying which transactions have matched, to manually assign team members to un-matched entries can help in timely bookkeeping and ensure financial regulatory compliance.

Let's personalize your content