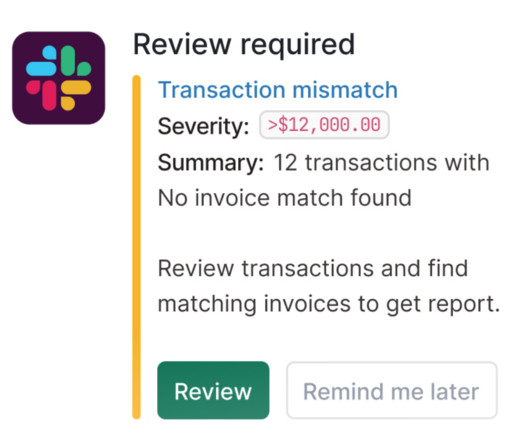

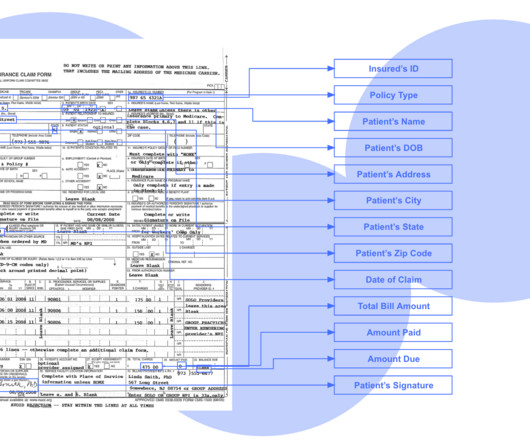

What are the Biggest Challenges Facing Compliance Teams?

The Fintech Times

SEPTEMBER 4, 2024

This month, The Fintech Times will look at some of the biggest issues regarding compliance and financial rules, as well as the solutions hoping to ease the compliance journey for firms and make the fintech world fairer and safer. We asked industry experts to find out. Keeping up with this can be a true headache.”

Let's personalize your content