Expense Reconciliation: Step-by-Step Guide

Nanonets

MAY 7, 2024

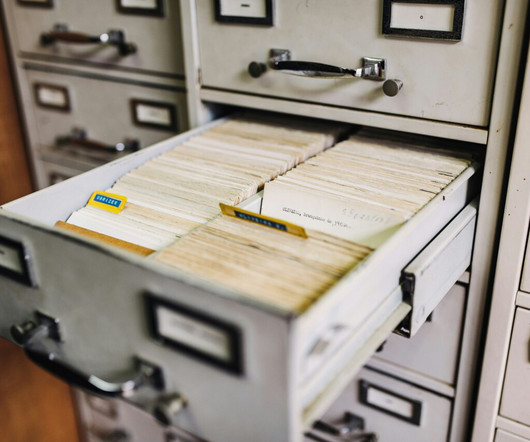

Expense reconciliation is the process through which businesses track expenditures, identify anomalies, adhere to regulatory requirements, and maintain financial accuracy and integrity. What is Expense Reconciliation?

Let's personalize your content