Credit Card Surcharge Signs: Compliance, Design, and Best Practices

EBizCharge

JULY 25, 2024

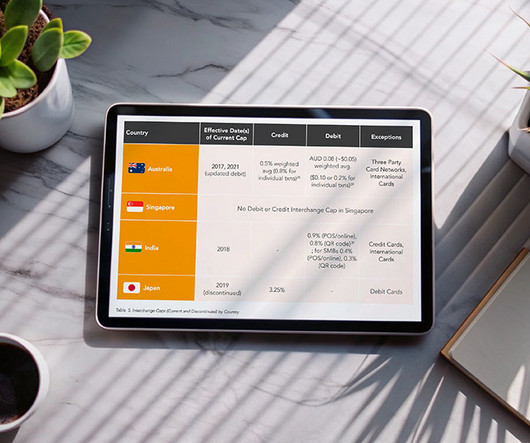

Looking for a Printable credit card fee sign ? Download PDF × With the prevalence of credit card use in 2024 comes the often-overlooked detail of physical credit card surcharge signs, which provide transparency of the fees merchants charge their customers to use credit card payments to purchase.

Let's personalize your content