Western Union to test debit, credit card offerings in bank push

Payments Source

MAY 5, 2021

(..)

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Source

MAY 5, 2021

(..)

Stax

DECEMBER 2, 2024

In recent years, market adoption of credit card surcharging—a practice by which merchants pass on the transaction fee for accepting a credit card to the cardholder—has increased dramatically. In 2024 alone, more than a dozen state legislatures introduced bills related to surcharging and consumer fees generally.

PYMNTS

NOVEMBER 12, 2020

Wells Fargo & Co is seeking to sell its private-label credit card and point-of-sale (POS) financing unit as part of an ongoing strategic review of its businesses. Selling the private-label credit card unit would be a business reversal for the financial services group. Debit card POS purchase volume hit $102.9

Stax

DECEMBER 9, 2024

As consumers, most of us have looked at last month’s credit card statement and experienced the panic of not recognizing a charge. But credit card chargebacks also occur for a variety of other reasons and they’re not always honest. What Are Credit Card Chargebacks?

Stax

JANUARY 15, 2024

Are you struggling with resource constraints caused by soaring credit card processing costs? Credit card surcharging can help offset these expenses, but it can be tricky. TL;DR Credit card surcharging involves adding a fee to transactions with credit card payments, offsetting processing costs.

PYMNTS

OCTOBER 1, 2020

The great digital shift is transforming credit cards into money management tools. Consumers want cards, and they want them quickly, and they want those cards [delivered] in a digital way," said Turner. Those processors will in turn work with issuing banks to offer near-instant issuance of cards.

PYMNTS

OCTOBER 18, 2020

The COVID-19 pandemic has produced one ray of sunshine amid otherwise devastatingly dark clouds: Consumer credit scores have improved in recent months to the point of hitting a new record high, the Wall Street Journal reported Sunday (Oct. The widely-used FICO credit score can range from 300 to 850. The average U.S.

PYMNTS

OCTOBER 12, 2020

In a time of increasing change for retailers and consumers, the current global climate has begun accelerating the future of retail trends at a much quicker pace than previously envisioned. However, one thing still rings true: Consumers need a reason to change ingrained behaviors. By contrast, U.S. By contrast, U.S.

Stax

DECEMBER 6, 2023

In an era defined by digital transactions and cashless payments, the process of paying for goods and services is more convenient, and increasingly reliant on credit card transactions. However, as the popularity of credit cards and digital wallet payments continues to surge, the costs associated with accepting them also do.

PYMNTS

JANUARY 20, 2021

In the intense tug of war in which brands engage for the love and loyalty of consumers, matters get rather more serious when discussing the austere nature of the banking hierarchy. 6 in the latest Provider Ranking of Credit Card Apps , pushing popular Credit One Bank Mobile to No. 5, finishing out this Top 5.

PYMNTS

OCTOBER 7, 2020

Americans cut their credit card balances in August for the sixth consecutive month, the Federal Reserve System reported Wednesday (Oct. Revolving debt — mainly credit card debt — as reported by the central bank declined by $9.4 billion in August compared with July. The figure now stands at its lowest level since 2017.

EBizCharge

DECEMBER 3, 2024

Since managing credit card transactions can be complex, understanding how their settlements work is essential to maintaining financial health as consumer spending rises. Credit card settlements involve various processes and parties that ensure transactions are accurately recorded and funds are transferred.

PYMNTS

FEBRUARY 21, 2019

Apple and Goldman Sachs, through joint efforts, will issue a credit card that links with the iPhone, the Wall Street Journal reported on Thursday (Feb. The new card is aimed at helping consumers with money management, and bringing the companies into new areas of business.

Fintech Finance

AUGUST 22, 2024

The service is available for the holders of NBK Debit Cards (Only on international spends), NBK Foreign Currency Prepaid Card, and NBK Multi-Currency Prepaid Card. The service is available for the holders of NBK Debit Cards (Only on international spends), NBK Foreign Currency Prepaid Card, and NBK Multi-Currency Prepaid Card.

Fintech Finance

SEPTEMBER 4, 2024

Almost £60 million has been reported stolen through card fraud over the past three years in the UK according to new research from Trustly, the global leader in open banking payments. Credit card fraud is the most costly and common type of card fraud, according to Trustly’s research.

PYMNTS

OCTOBER 10, 2019

Twelve years ago, LendingClub Founder Renaud Laplanche built a business to help consumers manage the $800 million in outstanding credit card debt. The Upgrade Card is tied to a line of credit that can be used everywhere that Visa cards are accepted. Interest rates on the Upgrade Card range from 6.49

PYMNTS

NOVEMBER 23, 2020

In an announcement of completion of the deal, Visa said it will accelerate the global payments and credit card company’s “network of networks” strategy. Visa has wrapped up its acquisition of Latin American FinTech YellowPepper , the first deal of its kind by the financial giant in the region. Terms of the deal were not disclosed.

PYMNTS

NOVEMBER 16, 2020

It takes consumer data to make PIX work. He said existing instruments will have to live together to allow consumers to decide what works best for them. Real-time payments continue to gain traction around the world. Case in point: Brazil. The country’s banking system is giving an upgrade to its instant payments system.

The Fintech Times

MARCH 30, 2024

Earlier this week, payment giants Visa and Mastercard agreed to lower fees charged to merchants for credit card transactions in the US, following a lawsuit spanning almost two decades. There’s no guarantee that even a dime of these savings gets passed on to consumers.

Paystand

DECEMBER 3, 2024

Table of Contents What Is a Push-to-Card (P2C) Payment? How Do Push-to-Card Payments Work? How Are Push-to-Card Payments Used? What Are the Advantages of Push-to-Card Payments? What Is an Example of a Push Payment?

PYMNTS

NOVEMBER 12, 2020

Safety-minded consumers the world over can now be seen tapping contactless cards, scanning QR codes or utilizing voice ordering technologies to make purchases without potentially putting themselves or others at risk of contracting the virus. The Beyond The Card: Toward The Cardless And Contactless Future report, a PYMNTS and i2c Inc.

PYMNTS

OCTOBER 2, 2020

In today’s top news, the European Central Bank outlines use cases for a digital euro, and Goldman Sachs will buy GM’s credit card business. for General Motor's Credit Card Business. for General Motor's Credit Card Business. Goldman Sachs will buy General Motors’ credit card business for approximately $2.5

Fintech News

OCTOBER 21, 2024

Initiatives like QRIS (Quick Response Code Indonesian Standard), a national standard for QR code payments launched in 2019, have allowed for standardization, making it easier for businesses and consumers, while collaboration between the government and fintech firms have helped enhance financial inclusion through clear regulations.

PYMNTS

SEPTEMBER 18, 2018

18), a San Francisco startup launched by sending roughly 60,000 credit cards to consumers living in northern California. This startup was a bank, and its innovation was a single card that could be used by consumers to purchase things on credit from many different merchants. Sixty years ago today (Sept.

PYMNTS

OCTOBER 20, 2020

The pandemic may still be forcing financial institutions (FIs) to confront the new digital reality — but opportunities abound for credit unions to engage with members who are, just now, growing a bit more positive about spending money again. Stepping Up On Credit . That’s the type of competitive advantage CUs should leverage, he noted.

PYMNTS

DECEMBER 11, 2020

That’s the reality that the majority of consumers — 78 percent, according to Blackhawk’s data — are already anticipating a post-pandemic world where their shopping habits will permanently shift to digital. Digital Gift Cards ’ Growth. She said a few factors — some more obvious than others — are pushing that trend.

PYMNTS

JUNE 22, 2020

And as the spending is curbed, from the top down, the economic recovery may be pushed out a ways, or even stalled. Drilling down into types of spending, two-thirds of the total reduction in credit card spending since January had come from that cohort. Call it the trickle down theory – in reverse.

FICO

JANUARY 22, 2021

But despite the COVID pandemic having effected massive changes in the ways consumers transact, credit card fraud is still a “thing,” and a big, ever-changing thing at that. Exactly how big credit card fraud is depends on where you look. Credit card fraud was the FTC’s second most-reported fraud type in 2019.

PYMNTS

NOVEMBER 18, 2020

Add to that the fact that consumers often don’t pay — not because they can’t, but because they get entirely lost in the “complexity … of payments hoisted on them,” he said. One such innovation has been i2c’s collaboration with SmartHealth to use an open banking platform to build the first credit card dedicated solely to healthcare.

PYMNTS

APRIL 2, 2019

Wells Fargo announced Tuesday (April 2) the launch of contactless consumer credit and debit cards. In a press release , Wells Fargo said the new cards will enable customers to complete transactions quickly and with a single tap at millions of merchants and transit systems that accept contactless payments.

The Fintech Times

DECEMBER 9, 2023

Consumer Duty, a set of rules aimed at enhancing consumer protection in the financial services sector, came into force in July 2023. 2023 saw the introduction of a new Consumer Duty, setting higher and clearer standards of consumer protection across financial services, and requiring firms to put customers’ needs first.

CB Insights

AUGUST 23, 2018

Live briefing: Consumer Banks in The Digital Age. Learn about the playbooks of today’s top banks as they digitally re-position their consumer products. JPM’s digital push, a theme it refers to as “Mobile First, Digital Everything,” is showing positive early results. First Name.

Payments Source

MARCH 16, 2021

merchants pay when consumers use credit cards online, pushing back the changes another year to April 2022 because of the pandemic. Visa and Mastercard are postponing plans to boost the fees U.S.

PYMNTS

SEPTEMBER 14, 2020

consumers now expect disruptions to drag on well into 2021. consumers are changing their spending habits around it. Some are doing so out of necessity, as the pandemic has pushed millions of Americans out of work as a nasty economic side effect. consumers have evolved into somewhat different people since the pandemic began.

PYMNTS

FEBRUARY 5, 2020

And even if it doesn’t quite make it over the trillion-dollar milestone, consumer spending will certainly get within striking distance – which attests to the fact that in the U.S. During the Black Friday and Cyber Monday shopping events and beyond, consumers were increasingly turning to buy now, pay later (BNPL) solutions in the U.S.

PYMNTS

MAY 27, 2020

As PYMNTS found in a recent consumer study, 40 percent of individuals are doing more of their daily retail and transactions online, partly because, well, there’s no other way to do it. Merchants, he said, “need to make sure they not only accept credit cards but also contactless payments.”. As Good noted, four in 10 U.S.

PYMNTS

SEPTEMBER 30, 2020

Dramatic shifts are underway in the retail sector as it adjusts to consumers’ increasingly digital preferences. Many consumers are shying away from physical stores, however, leaving these high-end merchants scrambling to develop strong online presences. billion this year — almost double last year’s total.

PYMNTS

SEPTEMBER 23, 2020

Consumer engagement has become a very different ballgame for financial institutions (FIs) in the past several months, as the physical branches that were the cornerstone of making connections with customers closed down. More generally, financial institutions are now in the position of having the highest [level of U.S.

PYMNTS

FEBRUARY 15, 2019

The costs of using some cards is going on the incline, as news is breaking that the nation’s two largest card networks, Visa and Mastercard, are preparing to up the fees charged to merchants to accept network-branded cards. The change will go into effect in early April, according to reports from The Wall Street Journal.

PYMNTS

OCTOBER 8, 2020

In today’s top news, Big Tech slammed the House antitrust report, and credit card debt has fallen for the sixth consecutive month. The country’s four largest tech firms wasted no time pushing back on the antitrust report from the House Judiciary subcommittee on antitrust, claiming that they all compete fairly.

Stax

JANUARY 31, 2024

If your company accepts credit card payments ( which it should ), chances are, you’re going to be affected by Visa’s interchange rates. cards currently in use. So it’s virtually impossible for a business to not accept Visa cards. TL;DR Interchange rates are the fees charged by credit card networks.

PYMNTS

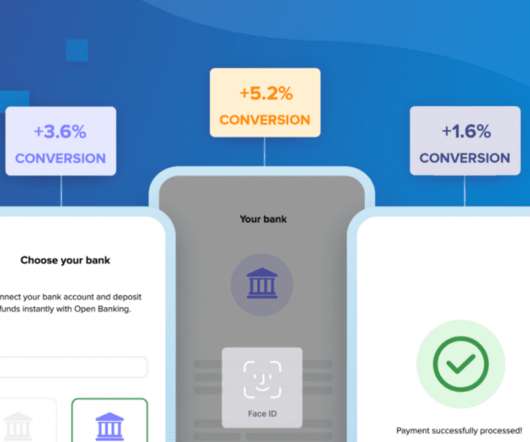

JANUARY 25, 2021

According to Ossama Soliman , chief product officer at open banking provider TrueLayer , the very fact that there are so many payment options pushes new entrants to differentiate themselves from the pack. “But But actually, it raises the bar for what it takes to add a new payment method into the checkout.”. Click, Biometric, Done.

PYMNTS

MARCH 20, 2019

In the age of smartphones, tablets and voice assistants, the morning or evening commute provides a myriad of opportunities for consumers to interact with the world. Those possibilities also extend to commerce, with connected devices paving the way for new shopping opportunities while consumers are on the road. Currently, 58.7

PYMNTS

JANUARY 18, 2021

The pandemic is causing fluctuations in the global economy, and supply and demand shifts are causing many businesses to face liquidity stresses and limited credit access. Such touchless payment options are being used alongside traditional ones like credit cards and checks.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content