Citi study shows mobile banking is vital to consumers

Payments Dive

APRIL 26, 2018

adults surveyed, mobile banking app use ranked third (31 percent) behind only social media (55 percent) and weather apps (33 percent), respectively. Of the 2,000 U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

APRIL 26, 2018

adults surveyed, mobile banking app use ranked third (31 percent) behind only social media (55 percent) and weather apps (33 percent), respectively. Of the 2,000 U.S.

Payments Dive

AUGUST 4, 2017

Mobile remote deposit capture is not the trendy feature it once was for banks. Today, consumers desire a way for banks to help them make the best decisions with their money. It's expected.

Fintech Finance

AUGUST 22, 2024

In keeping with its constant dedication to providing cutting-edge services to its customers, National Bank of Kuwait (NBK) announced introducing a new service that allows customers to confirm payment transactions online through the NBK Mobile Banking App, making itself as the first provider of this service in Kuwait.

PYMNTS

NOVEMBER 17, 2020

Consumers’ banking habits have changed radically since the pandemic was first declared in March. Not only are many account holders visiting brick-and-mortar branches less often than they did before the pandemic, but many are also more reliant on digital banking channels — particularly mobile banking apps — than they have ever been.

PYMNTS

JUNE 26, 2020

Financial institutions (FIs) worked quickly to ensure they could operate smoothly as the pandemic kept consumers at home and closed brick-and-mortar branches in Europe, the United Kingdom and the United States. Developments Around the Cloud Banking World. How N26 Is Using Cloud Core Banking for Nimble Mobile Innovation.

The Fintech Times

JANUARY 22, 2025

In 2024, consumer spending on in-app purchases and subscriptions hit $150billion globally, according to digital economy data provider, Sensor Tower. In its latest research, the firm uncovers how consumer spending on apps has evolved in the past year. Interestingly, consumers are not spending this money in the gaming sector.

PYMNTS

NOVEMBER 20, 2020

April was also the month that financial institutions (FIs) and Big Tech firms alike learned that mobile banking had become a much bigger, more important channel, virtually overnight. It took crashing the websites of a string of major banks and credit unions for the sector to grasp what happened. Mobile Experience Can Do More.

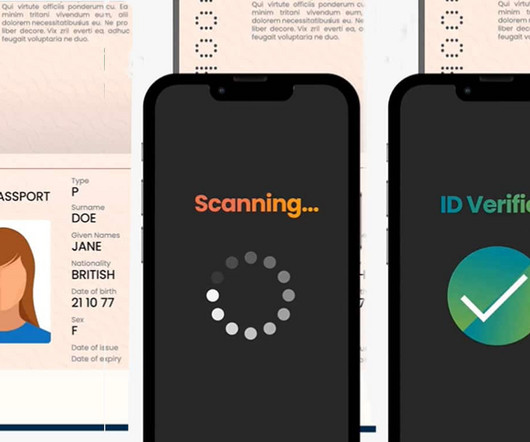

NFCW

DECEMBER 5, 2023

The passport-scanning feature will speed up the bank account application process and reduce the risk of error by enabling users to automatically populate data fields — including their name, title, date of birth, gender and country of birth — directly from their passport, the bank says.

PYMNTS

SEPTEMBER 18, 2020

Mobile banking upstart Chime has completed funding that has provided the firm with a $14.5 Chime, which CEO Chris Britt co-founded in 2013, provides clients mobile banking accounts without charges, debit cards and automated teller machine (ATM) access. consumers who make from $30,000 to $75,000 annually. “We

PYMNTS

NOVEMBER 24, 2020

Whether it’s increased demand for debit, installment plans or buy now, pay later (BNPL) arrangements, consumers today need multiple types of financial services, rather than a simple DDA account. But while some might think the mobile banking innovation trend is a U.S.-dominated Mobile isn’t a U.S. phenomenon.

Fintech News

NOVEMBER 6, 2024

OCBC Bank has launched a new service allowing customers to send money instantly to users of WeChat Pay and Alipay in China. This makes OCBC the first bank in the Asia Pacific region to offer this capability. This will allow customers to send money to friends and family abroad or even make direct payments to small businesses overseas.

The Fintech Times

JANUARY 30, 2025

With smartphone theft on the rise across the UK, fintech and mobile security platform, Nuke From Orbit , is launching a nationwide campaign to combat this growing crisis. Our goal is to empower people with simple, effective ways to protect their mobile devices and create new habits that secure their personal data as we kick off the new year.

PYMNTS

SEPTEMBER 17, 2019

A 5G network could markedly improve mobile banking apps’ speed, security and ease of use. Mobile banking apps have already enjoyed mass adoption, but what are consumers using them for? And, perhaps more importantly, what do they want from digital banking apps that they aren’t currently getting?

The Fintech Times

MAY 17, 2024

Consumer payment preferences are constantly evolving, meaning firms need to adapt to cater to these needs. At the Visa Payments Forum in San Francisco, Visa has unveiled new products which will address the evolving consumer payments demands. We’re announcing the next generation of truly digital-native payment card experiences.

PYMNTS

JULY 15, 2020

MoneyLion , the New York-based mobile bank, announced the launch of RoarMoneySM, a demand deposit account powered by MetaBank N.A. It features two-day early paydays, mobile wallet capabilities, funding options, near real-time transaction alerts and advanced cybersecurity, the company said in a Wednesday (July 15) press release.

Payments Dive

AUGUST 17, 2017

Across the globe, financial institutions are under mounting pressure to meet high consumer expectations, capture and retain market share, and secure mobile transactions – all at the same time. Some are lagging, while others are upgrading technologies and investing in innovation and testing departments. So, how did we get here?

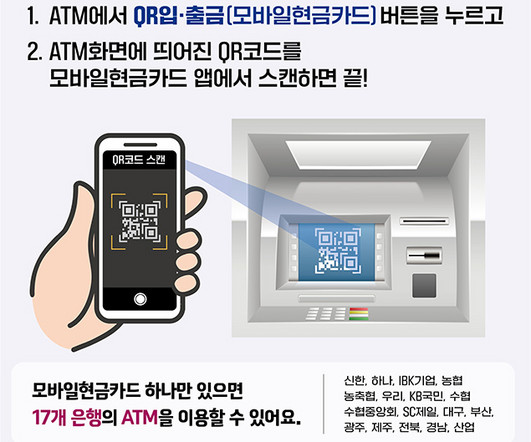

NFCW

DECEMBER 18, 2023

SCAN: Availability is being expanded from NFC on Android phones to QR Codes on all smartphones Consumers in Korea can now make cash withdrawals and deposits at ATMs by scanning a QR code with their Apple or Android smartphone rather than needing to use a physical bank card.

PYMNTS

JANUARY 14, 2021

There is no shortage of digital-only banks offering a smoother onboarding process, a slick mobile interface and fee waivers in an effort to tempt consumers to leave their traditional bank. 14) that it is jumping into the world of mobile banking with the launch of a debit rewards product somewhat eye-catching. “We

Fintech Finance

OCTOBER 21, 2024

According to data from CaixaBank cards towards the end of the first half of 2024, more than 30% of in-person purchases made in Spain with CaixaBank cards were made using mobile phones. By speeding up the purchase process and offering the option to divide payments into instalments, shoppers can enjoy a faster user experience.

Fintech Review

FEBRUARY 13, 2024

With innovations like mobile banking, digital wallets, and blockchain technology at the forefront, fintech is leading a financial revolution. However, this rapid growth brings significant regulatory challenges, primarily in balancing the need for innovation with the imperative of consumer protection.

Payments Source

FEBRUARY 11, 2020

The German challenger bank said that its "several hundred thousand" customers in the U.K. have until April 15 to withdraw money or transfer it to another account.

FICO

NOVEMBER 10, 2020

Many of the world’s leading banks and card issuers trust our Falcon Platform , which protects more than two-thirds of the world’s credit card and debit card transactions from fraud, as well as other forms or real-time payments and consumer banking funds transfers. Consumers Want to Be Involved. The alternative?

NFCW

MARCH 27, 2025

Device manufacturers will have new opportunities to bring innovative products to the market, improving the user experience for consumers based in Europe.” “Moreover, physical smart cards can easily be read for instance to activate or secure mobile banking.”

Payments Dive

OCTOBER 19, 2018

Digital channels are being widely accepted by today's consumers, but with this adoption comes the increase in impersonal transactions through online and mobile banking, drastically impacting the traditional model of building relationships

PYMNTS

FEBRUARY 14, 2020

To that end, SilverCloud CEO and Founder Scott Cornell said that financial institutions (FIs) would do well to take cues from shifts in consumer expectations of the levels of service they receive from tech-savvy companies – and should carry those lessons over to their corporate banking relationships. The Corporate Connection.

Payments Source

JANUARY 3, 2019

Leveraging the trust relationship the bank already enjoys with its customers, based on robust security, engagements can go beyond run-of-the-mill transactions, writes Sherif Samy, senior vice president of North America at Entersekt.

Payments Source

OCTOBER 16, 2020

The events of 2020 have only served to accelerate a number of potentially disruptive trends among consumers when it comes to banking and financial services — What does the emerging future of consumer and retail banking now look like?

Finovate

APRIL 2, 2024

Indiana-based New Washington State Bank (NWSB) has selected Apiture’s Digital Banking Platform to power its online and mobile banking solutions. The community bank will also deploy Apiture’s Account Opening and Data Intelligence solutions to onboard customers faster and to offer tailored campaigns.

Finextra

MAY 1, 2024

Mobile banking startup Monese has confirmed the break up of the business into separate consumer-facing and corporate concerns and the arrival of new funding.

Payments Source

APRIL 3, 2019

With many consumers now using online and mobile banking, there is a huge opportunity to incorporate blockchain solutions into the everyday payments experience, writes Andre Stoorvogel, director of product marketing for Rambus Payments.

PYMNTS

DECEMBER 14, 2020

The pandemic has had a significant impact on consumer adoption of online and mobile banking services as more people are digitally engaging with their banks to curb health risks. Mobile banking use is ticking up, especially among younger users, with PYMNTS data showing that 75.9

The Payments Association

OCTOBER 14, 2024

Traditionally, consumers stuck with familiar banks, but there’s now a growing trend of current account switching. In contrast, digital banks like Monzo and Starling are attracting customers by offering lasting value through user-friendly platforms and innovative features.

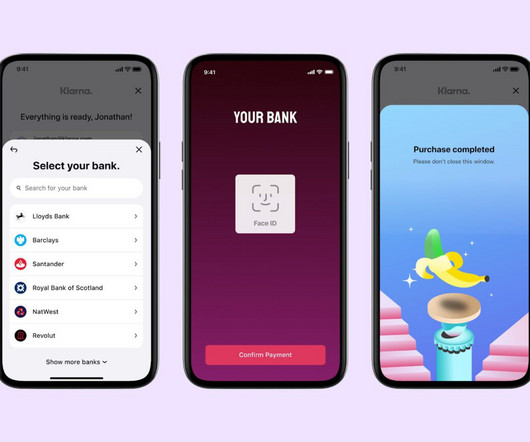

Fintech Finance

MARCH 14, 2024

Klarna , the AI-powered payments network and shopping assistant, has begun to roll out open banking-powered settlements in the UK. The launch to Klarna’s 18 million UK customers gives open banking a significant boost in the UK, where approximately 5m Brits use open banking payments each month.

The Fintech Times

APRIL 10, 2025

Through the launch of Pay by Bank from Payit by NatWest as a payment option on its platform, Utilita is enabling its customers to instantly add funds to their smart meter or wallet through the My Utilita app. The integration of the Payit service from NatWest comes as part of its mission to offer consumers better service and a fairer deal.

Fintech Finance

FEBRUARY 27, 2025

Entrust, a global leader in identity-centric security solutions, has announced the launch of the NFC Issuer Wallet Solution for iOS, allowing European financial institutions to build their own wallet within their banking app, in addition to deploying the Apple Pay Wallet.

Payments Dive

JULY 19, 2018

The combination of mobile banking and biometric security in our smart devices will enable consumers to have more confidence regarding their personal security and will be far safer than it has ever been.

The Payments Association

OCTOBER 28, 2024

In the world of digital payments, fraud is an ever-present threat that continues to evolve, creating serious risks for both businesses and consumers. This can be attributed to the increasing sophistication of fraud detection tools, improved authentication measures, and greater consumer awareness of phishing scams.

PYMNTS

JANUARY 14, 2021

Since the onset of the pandemic, banking activities like opening new accounts and applying for loans are now being done virtually to socially distance and help curb the spread of the virus. This means consumers are turning more to digital tools, but unlocking and embracing the potential benefits of these tools has not been easy.

PYMNTS

NOVEMBER 18, 2020

The Federal Trade Commission (FTC) has alleged that the mobile banking app Beam Financial has misled customers about quick transfers of funds, a press release says, with some customers receiving funds late or not at all.

Fintech Finance

MARCH 27, 2024

Keynova Group , the principal competitive intelligence source for Mobile Banking Payments firms, has announced the results of the Q1 2024 edition of its semi-annual Mobile Banker Scorecard. Bank continued its winning streak, ranking No. mobile bank offerings.

Fintech Finance

OCTOBER 22, 2024

Entrust , a global leader in delivering identity-centric security solutions, today announced that The Huntington National Bank has selected the Entrust Digital Card Solution to enable digital wallet capabilities, with instant provisioning to third-party digital wallets from its mobile banking app.

The Fintech Times

MARCH 14, 2024

Klarna has introduced open banking-powered settlements in the UK, enabling consumers to pay directly from their bank accounts instead of using debit cards. Open banking settlements simplify and secure transactions for consumers while providing insights into spending habits.

PYMNTS

JULY 30, 2019

Consumers making less than $30,000 a year are twice as likely to incur an overdraft penalty fee than those who make more. But the vision for Money Lion isn’t to be a bank in the best understood version of the term, he said, because “the last thing anyone needs is another traditional bank.”. In the general U.S.

PYMNTS

SEPTEMBER 4, 2020

Signs are that it’s a hit with consumers. It’s one of numerous revelations in PYMNTS’ Leveraging The Digital Banking Shift Report , a collaboration with Feedzai , based on a survey of nearly 2,200 U.S. percent of online banking customers using digital channels more. percent of bank customers say they commonly do so.”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content