Preparing Merchants For The Coming Mobile Wallet Boost

PYMNTS

MAY 27, 2020

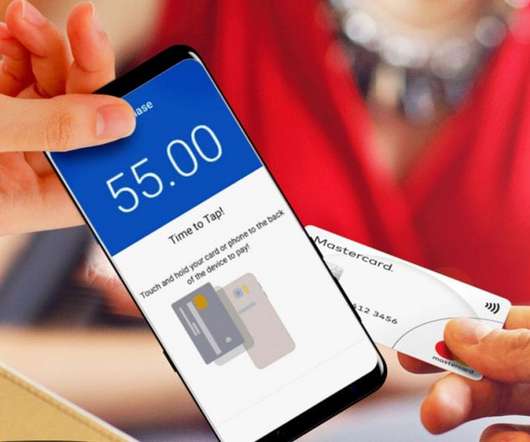

To that end, said Matt Good , senior vice president and general manager of Elan Advisory Services , the shift to contactless payments is well underway — and the stage is being set for mobile wallets to gain a much wider embrace. Even waving the card at the point of sale (POS) may face headwinds because of transaction limits.

Let's personalize your content